Hello everyone !! Hope you are fine and your trading goes as per your expectations. Two days back I came across a question from a fellow trader “Which is the best scanner for stock selection?” He said that his mind is cluttered with too many scanners in stock selection. He is confused with too many platforms available online and which scan to select and which stocks to select from them.

Well the question was not surprising to me since I had the same difficulty when I started trading. I would scan in screener then in stock edge then Market Smith, Chart link and what not. Whenever someone posts an analysis chart with fundamental data I will be wondering which platform it is. My mind will think that this platform will scan for “ the best multi bagger stocks”. Will be in search of that platform, scan something in it and get some stock list ready. In two days I’ll forget about those stocks and will again be creating a stock list through some other platform.

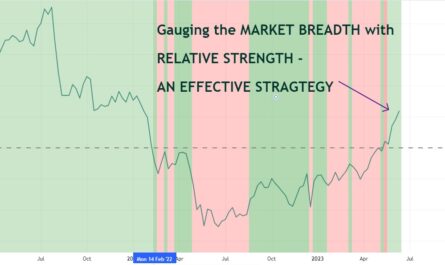

If you are in such a phase in your trading Career, don’t worry. You are not alone. Everyone goes through it. I had already written two articles on how to select stocks based on relative strength and based on Mark Minervini trend template. In this article I will try to share my experience on how to select a scanner and whether a scanner is that much necessary to catch the big moves.

Understanding scanner and Yourself :

First, a scanner is nothing but a program which scans the stocks available in the market and gives you a list of stocks based on the criteria given to it.

Having said that, without any input given you are not going to get any output, say stock list.

Now, the question is: What input do you have to give? That’s where the problem and confusions start. Whether to look for fundamental scans like EPS growth, sales growth, PEG ratio, PE RATIO, Net profit margin, Profit after tax, etc., or to look for technical scanners like Darvas Box breakouts, Gap ups with volume, three white soldiers, stocks whose 50 DMA (moving average) crosses 200 DMA from below etc.,

The root of the confusion is nothing but you want to find the best of the best scanners. You don’t want to go wrong by selecting a stock that is not the best. Kindly understand it’s not the scanner it’s you who will find and ride the multi-bagger. Remember even after your meticulous stock selection it can go wrong horribly but a moderate stock with moderate EPS can outperform easily. Stock market looks the future and discounts everything else in the current scenario.

Be clear of what you want to scan and do accordingly.

Fundamental Vs Technical Scanners:

I am not a fan of scanners at all. I don’t believe in scanners because they can never fulfill my expectations. I believe in what I see on charts first and scans are just an add on if I use it occasionally.

I use some basic fundamental scanners, like EPS growth, growing EPS in the last few quarters, Net sales and profit growing in the last few quarters That’s it. No other scan I do.

I just want 5-8 stocks or at maximum 10 stocks to hold in my portfolio and ride the trend as long as it lasts. Having a small concentrated portfolio is a must for super performance.

Also, I don’t scan for technical specifications at all. This is because reading a chart is a complex process and one should be reading the stock daily that he/she plans to buy.

It should be in your watchlist not on the day of breakout, but at least a week before the big move happens. That’s how you can catch bigger trends. My recent trade of KPI Green is an example. The stock was there in my watchlist for more than a month. My daily job is to watch it closely. Whether it gaps up or gaps down, volumes on the up day, how it behaves around the consolidation range. Everything was recorded in my mind.

On the day of breakout I am into the stock right before it hits the upper circuit. Anyone can do this, if one focuses on smaller details. I entered LINDE INDIA, IFBIND (not a recommendation, please do your own research before you buy) in the same way some days back.

THE HUMAN SCAN:

The best scanner in the trading world is your brain and eye. No programmer in the world can beat it. The intuition, the feel and the thought process that you undergo when selecting a stock can never be replaced by a computer, how advanced the AI can become. See the chart below:

The chart is of IFBIND not a recommendation. I am not SEBI registered. You can see that the chart started making moves in the low Cheat area itself. No scanner can give or tip off such an entry unless you scan manually with your eyes.

Even if you had not entered there, this stock should have been on your watchlist prior to the breakout. Not on the day of breakout into the All Time High zone. Your conviction will be strong only when you start traveling the footprints of your stock for some time. Also note the volume was highest on the day of break out at the cheat level. Not on the breakout day to ATH zone. If your scanner scans this, it will process that the Volume this week is very low than the previous weeks then the stock is going to be left out.

Now, what do you think about the stock? Is it going to move or fizzle out? Of course nobody can predict that. But the possibility of the stock moving higher is great.

So what do I do?

Let me share a few things about what I do. It may not be suitable for everyone and opinions may vary.

Scanning the entire market:

I go through all the stocks in NIFTY Total market index one by one. Go to niftyindices.com and select the index constituent and download the list into Tradingview.

In that list after going through one by one I remove all the stocks that are not trading near to all time highs.

I want the stock to be well within 20-25% from it’s all-time high or at the max 35% if the structure is really good.

I then shortlist the stocks that are forming a clear non confusing pattern. I look for only three patterns,

VCP Pattern, Cup and Handle pattern or High tight flag pattern.

That’s it. From a total of 750 stocks now I will be having only 80-100 stocks that have a clear pattern near All time High zones.

Now, this is my watchlist. I then look for stocks with good fundamentals, rising Relative strength etc. I had written an article on how to find Dark horses using relative strength. Read it. Now, you will have hardly 40-50 stocks. Now look for stocks with good fundamentals like EPS growth, sales growth etc., as per your interest.

Don’t expect a stock to meet too many criteria, you will miss out on super good stocks. In the real market you will never find a stock that fulfills all criteria. This is not a disadvantage, this is the edge you should develop. A skill to nurture and build.

I then set alerts for the levels I like to enter . But even then I go through these 40-50 stocks daily irrespective of alerts / market conditions etc. Alerts are just a reminder to make life easier. But I don’t decide after the alert gets triggered. My position size, my risk amount, everything is pre planned.

Scanning a small universe of stocks:

If you feel it is too much work to scan the total market and you want to simplify it then go behind Indices like Small-cap 100, Microcap 250 or even Nifty Alpha 50. These are good liquid stocks that one can trade without much fear.

After all, you are going to have only 5-10 stocks in your portfolio. The deciding things are, when you start building the positions, how much you build, whether you are able to hold these stocks till your exit rules are met and your psychology to drawdowns etc.,

Also,stock hunting should be done when the broader market is having a pullback or when a correction is happening and never when the broader market is on the fly. You should read the article “Bear market survival tips” to understand what I mean.

Newer names:

Apart from the Nifty total market one area where one should look into is the IPOs. By IPOs, I mean not the ones that are getting listed next week but the ones that were listed 2-3 years back. I had written an article on “How to trade IPO’s like a Pro?” Read it to understand how to pick big upcoming winners.

I use the Trendlyne website to get the list of recent IPOs. You can use any platform of your choice.

Key Takeaways:

You can scan for fundamentally good stocks and then select strong stocks based on technicals or vice versa.

The way of handling your positions is way more important than your strategy to select stocks.

Having a small universe of stocks will help you focus and pounce on the opportunity when it arises.

Situational awareness of how the market is functioning and proper risk management are the keys to success or if you want to call it the Holy Grail of success.

Most traders think that strategy can win millions for them, unfortunately it is not. I have written many useful and important articles but the most read article or super top performer article of my blog is the one I wrote on ANTS Indicator. While it is a good topic to select stocks, it is not that important as opposed to what I have written on risk management and position sizing and drawdown control.

I also publish my trading journals both winning and losing ones. You can look into it if it’s helpful for you.

Consider subscribing to my newsletters if you like them.

Happy Trading !!!

Dear Vimal, you are doing great work by sharing the knowledge , best wishes and more power to you.

Thanks for the kind words. Wishing you all the best in trading and life !!