Human minds are trained from childhood to ignore small things and focus on big things. We tend to underestimate the small changes that occur in daily life and overestimate the importance of one defining moment that will be noted and talked about by everyone. We want to show the world that “one earth shattering moment” that changed our lives forever.

However, we forget that it’s the small changes or actions that we do daily that turn into bigger things in future. Success is not an overnight thing, but is a culmination of constant hard work with persistence and consistency.

Trading or investing in the stock market is not any different. The daily images in social media showing their profit screenshots, or a trader showcasing how he bought a new luxury car after a single trade, highly misleads the common retailer. The retailer also wants to show others that he is also successful to that extent. This sense of instant gratification affects his/her trading decisions and the focus shifts from following the process for success to following the profit /loss statement.

If you are a beginner or already a trader/ investor with not so great success, don’t worry. It’s time for us to improve ourselves day by day. To define each and every action of us day by day, taking cues from them, taking notes, adjusting positions and repeating the process again and again. We will keep on trying, to improve ourselves little by little and this process itself will take care of our success.

James Clear in his book – Atomic Habits – says that if you improve yourself 1% every day, at the end of year you would have improved by 37%. Great, right? Read on…

So, in this article I will be sharing my views on how to track a trade or investment you make and how to prepare a trading journal. I will share my excel sheet on how I do it, which you can download and use it. I will also let you know of a free site where you can journal your trades with less effort.

This article is for persons who do day trading, swing trading or positional trading. However, even investors can also use the same to evaluate what works better for them. But, if you are a buy and hold type of person it may not be of much use.

The article will be a little lengthier. Sorry for that. But, I wanted to share all the best things possible related to “Journaling the trades” in this article. Kindly be patient and read the article till the end and refer again and again if the terminologies are too complicated in the first read. Happy reading !!!

Trading Journal – Things to note:

In every trade you take there are three situations when you should journal your trade:

- Before the trade begins

- During the trade and immediately at closure of the trade

- After few days or weeks once the trades are closed

We will see what all the things to be noted in each situation going forward:

Trading Journal – Before initiating the trade:

Before initiating a trade one should have the following things in their mind. One should never attempt any trades before deciding the following factors:

Account size:

This represents how much your trading capital is going to be. If you are an investor this defines the entire capital you are going to deploy in buying stocks. Having an appropriate account size is the first and foremost thing one should be clear of.

Position size:

This is the amount of money you are going to deploy in each trade. There are various types of position sizing strategies. One should be familiar with these things and be ready. Among the position sizing strategies, the one that appeals to me the most is the percentage based model.

Other things to be noted:

- How many shares are you going to buy for a particular trade?

- What is the Stop Loss percentage you are willing to take?

- What is your target going to be?

- What is your entry strategy?

- What is your exit strategy?

- How are you going to add into positions? In one shot or in tranches?

- What is the plan for booking profits?

- How are you going to trail the stop loss?

- What is the maximum drawdown you are expecting in case of black swan event?

Emotional Quotient:

One should ask themselves and write down how they feel on the day of taking that particular trade.

It may happen that any good news flow related to stocks or any good news in one’s family may alter the mood and the trader may become over excited and mistakes can happen due to overconfidence. Similarly bad news can also hamper the mindset of the trader.

Trading Journal – Things to note during and immediately after the trade gets closed:

There is a lot of information and data one can note / collect from their own trading. However, I am going to discuss only those things that I use in my trading journal and you can twist and turn, add, delete depending on your needs.

- Entry Price

- Quantity

- Stop Loss planned

- Exit Price

- Structure for entering the trade (Pullback, Breakout, Flag pattern, Channel Breakout etc.,)

- Initial Risk in the trade (Entry Price – Stop Loss)

- Amount Invested in each trade

- Profit Gained and Loss incurred

- Profit / Loss in percentage

- R Multiple – (Profit gained / Initial Risk)

- Entry Date

- Exit Date

See the screenshot below: This is how I maintain my trade journal: (Please note that the trades shown in the image are just for example purposes and does not necessarily mean real trades)

If you want to journal the trade exactly the same way as above you can download the excel link here. Trade Journal Wealthinzen.xlsx

The significance of R Multiple:

Of the all data above the most important for me is the R multiple.

R multiple is nothing but the profit percentage you gain for the risk you have taken. It is calculated by dividing the percentage of profit at the exit of the position by the initial risk taken during the entry of that position.

For example, if your risk is 0.5% at the time of entry and your profit is 1% then the R Multiple is calculated by 1 / 0.5 = 2. Hence, R multiple is 2R.

Similarly, if your risk is 0.5% and you end up with a profit of 1.5% then R multiple is 1.5 / 0.5 = 3. Thus, the R multiple is 3R.

Taking constant note of R Multiple for every trade you take will give you a lot of insights of your trading style and account size you need to have.

Trading Journal – Things to take note after the trades are closed:

The biggest mistake a trader makes in journaling the trade is, they completely forget that trade once it is closed. But, the ultimate insights come and the journal cycle gets completed only after you review the trade after closing it.

This review can be done

- once in a week if you are a day trader,

- once in a month or two if you are a swing trader,

- or once in a quarter or half yearly if you are a positional trader.

This review should be done for all the trades made (closed trades only) during that particular time period.

And from that the following observations should be made.

Total winning and Total losing trades:

Of the total trades, how many trades were profitable? Consider it as a win even if the profit is negligible.

Also, note how many trades were loss making ones.

Winning Percentage: (Also called as Batting Average)

This is the percentage of trades you win on average of the total trades you take.

For example if you are taking 10 trades, out of the ten trades if you win 5 times and lose 5 times. Then your winning percentage is 50%.

Similarly if you win 6 times and lose 4 times then your winning percentage is 60%.

Average Profit / Loss % Generated:

This is the average of all the wins and loss percentages that were generated during that particular time period. You can refer back to the sample excel sheet above where the average profit percentage generated is around 6.41% for that time period.

Average period of Holding:

This is a metric used to know within what time period the profit was generated. For example, if you are generating 6% profit on average in 200 trading days then it means that you have not beaten even the bank Fixed deposits.

Profit Factor:

This can be measured by dividing the profits generated by profitable trades with the losses from losing trades. If it has a value greater than 1, it means profitability. Similarly a higher value like 2,3 denotes more profitability.

Commissions:

Calculate the average commissions that you have to pay from the profit. This includes brokerages, STT, DP charges and other things. This can be easily calculated by using the brokerage calculators of the respective brokerage websites, you are having a Demat account with.

Chart Reviews:

Another most important and effective thing one has to journal is the charts of the broader market, at the time of taking trades. As traders we are more often glued to the stock we have taken position. However, we tend to forget that it is the under-current of the broader market that makes the moves in the stocks.

Also, journal the sector chart of the particular stock you have taken position. For example, if you are taking a position in M&M auto stock, along with the chart of M&M, journal the charts of Nifty Auto and also Nifty 50 or Nifty 500. This will give valuable inputs on which stocks we should focus in future and how to pin down on fewer stocks. You will also come to know that taking positions in the leading sector increases your odds of winning.

You can read my article on how sector rotation plays an important role in trading success here.

wealthinzen.com

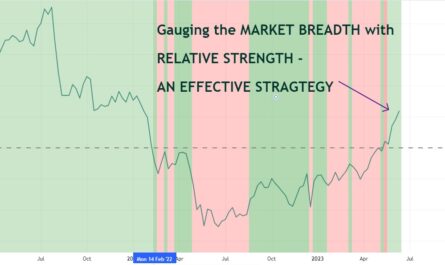

See the image below:

From October 2021, the broader market is in continuous down move forming Lower high and lower lows. If you are performing poorly in the past 1 year it does not necessarily mean that your strategy is not worthy enough. It may be due to the poor performance of the broader market also.

So, journaling these things will help you understand which time of the market you should be playing offensive and when to be defensive.

Free site to Journal your trades:

I really appreciate your patience for reading this lengthy article till now. But, I can also sense that most of you would be wondering how one can maintain all these things. Particularly if you are working somewhere and you are not a full time trade, keeping an extensive journal may be difficult.

But, I found a wonderful website called “TradeBench” which is completely free to use. I should tell that for a free website the features available in that site are fantastic.

I will share some of the things you can do with TradeBench. (All the charts and images are representative only, they are not real trades and I am not affiliated to this site)

Realized Profit & Loss Graph:

You can check how your account grows from the time you started to trade.

See your open trades with unrealized Profit and Loss:

Adding Charts to the Trading Journal:

Other Possibilities:

You can see the initially planned trade summary, actual trade summary, tag different strategies, view the results for each strategy, you can pre set your SL etc.,

One main thing I love about this site is that it provides you with a detailed review of all the trades you took in a given particular time period. See the image below:

The image represents the reports and review of the trades taken between Jan 01-2021 to October 15-2022.

I would highly recommend trying this free site if you want to journal your trades like this.

Key Takeaways:

- Trading journal is an important thing every trader should track and review periodically.

- Learning from the mistakes is the best way to success.

- Try to read the lost trades more frequently than winning trades. Looking into winning trades will boost confidence but ultimately it is the failures that teach us. Also, loss making trades keep us grounded.

- Be consistent with journaling. It is like a diary that should be kept dear to your heart.

- Take regular print outs of your closed trades and write some of your thoughts over those print outs instead of typing everything. Writing has a special effect in training the mind effectively.

- If you are happy with my writings and want to get updates on a regular basis do subscribe to my newsletters below.

Good Writeup… Keep it up ☺️

Thank you for the kind words.

Thanks for the appreciation

Hi, It’s interesting and good information . Keep it up.

Hello Sateesh,

Thanks for the kind words. Hope you like it. If you find it interesting do share with your friends. Also, thanks for subscribing. Please make sure that my mails reach you in primary inbox instead of promotions tab.