Hi all !!

Hope all are doing well. If you remember, around a year back, I had written in detail about how one can use ANTS indicator or MVP indicator. I had mentioned how one can use that for trading success and catch bigger moves in a stock.

If you are wondering what ANTS Indicator is, it is a powerful trading strategy developed by DAVID RYAN, which forms the basis of DAVID RYAN’s Trading Strategy. I would suggest you first read my article here. Reading that article is necessary to understand the current topic.

In that article, I had discussed a few names which have shown some institutional buying signs. As one year has passed, I just thought why not go back and see how those stocks have performed and how well this indicator was able to catch the trend.

Stocks that showed Institutional buying Signs:

First, let us see what criteria was needed to decide whether there were strong hands behind the stock.

Any stock that exhibit institutional buying, should have the following three criteria (MVP) met as per David Ryan:

Momentum (M):

Stock should be in a continuous up move. It should be up in at least 12 out of 15 days prior to the move.

Volume (V):

Volume should be rising at least 25% or greater comparatively in those days. Particularly there should be a continuous increase in volume as the stock moves up in that 15 days.

Price (P):

The price of the stock should have increased by at least 25% or more in those days.

The stocks that met these criteria on that day of writing (NOV 2022) was:

- IRFC,

- RVNL,

- Canara bank,

- Ambuja Cements

- Union Bank of India,

- Punjab National Bank

IRFC:

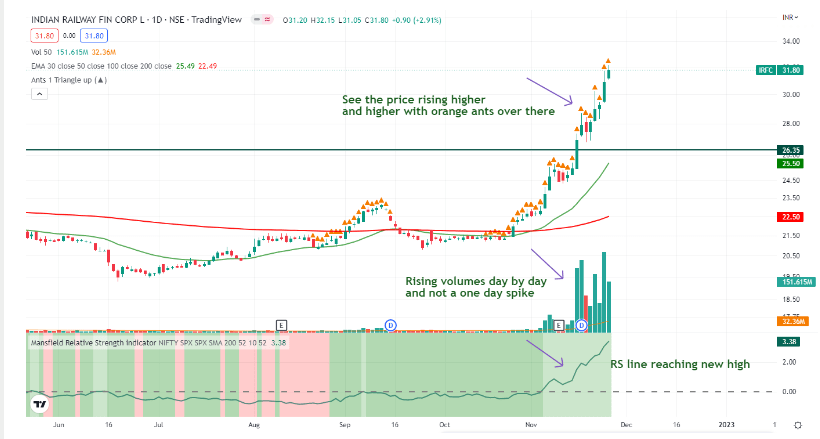

See the chart below. This was posted in my article in NOV 2022. Before the move happened:

As of today from that point the stock has risen from price around 30 to 76 now. See the chart below:

RVNL:

RVNL, which is a sister stock, also showed some tremendous institutional support during that time. Sister stocks usually tend to move together. Read my article on ” how to find sister stock movements and make money consistently”

See how beautiful the stock has performed from the time the signal was formed. Also, see how the signals were formed again and again as the stock moves up indicating that the strong hands were still buying them.

Kindly note there may be some differences in the chart I posted a year back and this one as the stock charts are frequently updated for dividends, stock splits etc.,

Punjab National Bank:

CANARA BANK:

Union Bank of INDIA:

AMBUJA CEMENTS:

I know by now, you will be feeling very high of this indicator and you would have even thought this is your Golden Indicator. But that is not true. Any indicator will fail. If it does not fail then it’s not an indicator it should be a “SCAM”.

One such stock that showed tremendous promising signal but failed severely is AMBUJA CEMENTS:

However, note that the stock never gave an entry. The cup and handle I was waiting for never broke and the stock went down up to 45%.

” THINK OF FAILURES FIRST – THEN YOU WON’T FEAR OF FAILURES “

Swami Vivekananda

SUMMARY OF RESULTS:

| Stock Name | Approximate Percentage Gain / Loss IN % | Result Outcome |

| IRFC | 144 | Extraordinary |

| RVNL | 145 | Extraordinary |

| PUNJAB NATIONAL BANK | 45 | Good |

| CANARA BANK | 30 | Average |

| AMBUJA CEMENTS | -47 | Poor |

| UNION BANK OF INDIA | 78 | Very Good |

Bottom line:

As per my review, the indicator has done extremely well.

But one thing to note is how these stocks except AMBUJA have an affiliation with the government. These are public sector stocks.

When certain changes happen in the backend of a particular sector, you can see almost all the stocks of that particular sector rising up. That’s why understanding sector rotation can compound your trading success.

You can also read my article on How I found out the outperformance in small and mid cap stocks in JUNE 2023 using Relative strength.

wealthinzen.com

Though, this indicator can give good signals you can’t enter right away. Stock selection, proper entry, maintaining a good position size and progressive exposures along with risk management always play a major role in stock market success.

This article also shows how one can always read back their predictions and become more and more precise in stock trading. That’s why I always maintain a Trading journal. Read “How to make a perfect Trading Journal to make millions “

I also publish my trades taken both won and lost trades in my trading journal series. If you like my article you can consider subscribing to my newsletters and get my articles delivered right into your inbox.

Happy Investing !!!

One thought on “Back-testing ANTS Indicator – My review of MVP Indicator by David Ryan”