SIP / Systematic investment plan is an option where you invest a pre-specified amount every week / month in an asset class be it equity / gold / Debt Fund or any other assets in a disciplined manner. This is similar to the recurring deposit where every month a pre-specified amount will be invested in RD from the account.

Till recently SIPs were only common for mutual funds. As the awareness of the equity market is growing and the knowledge on investing has grown up, people look for alternate options of investing in equity apart from mutual funds. SIP in stocks is a boon to many novel investors who don’t want to invest in mutual funds and at the same time want to invest in equities in a systematic manner. SIP in stocks allows you to buy your preferred stocks in a much disciplined manner thereby accumulating it for longer benefits. In this article apart from general Advantages and Disadvantages of SIP we will be specifically discussing the differences in SIP of Stocks Vs Mutual funds.

How different is SIP in Stocks from Mutual Funds SIP?

In mutual funds, retail investors give money to the fund houses. The fund manager on behalf of you selects the stocks and invests your money. While you have the option to choose the fund scheme / Fund House / Fund manager you don’t have the freedom to choose the stocks in your fund. Whether you like or not you have to invest in the portfolio your Fund Manager selects for you. But in SIP of Stocks you can select your own stock portfolio and invest in it in a disciplined manner through SIPs.

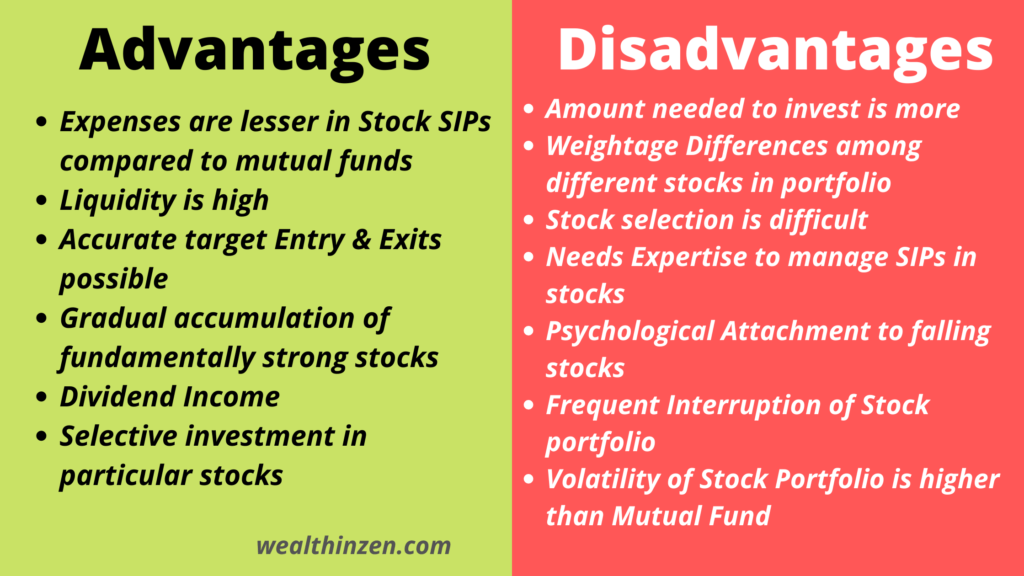

Advantages:

Expenses:

SIP in stocks is a “ Do it Yourself ” method of investing. There is no fund house or fund manager involved unlike Mutual Funds. So, there are no expense ratios in Stock SIP. Investors who don’t want their portfolio returns eaten up by expense ratio usually prefer to invest in stocks directly. Other expenses involved in Stock SIP are similar to the ones when you buy and sell a stock from your demat account.

Common expenses include DP charges, STT, SEBI charges, stamp duty and exchange transaction charges. However, these charges are charged only during selling the stocks, unlike expense ratios in mutual funds where some amount will be deducted from your investment daily. If you select discount brokers like Zerodha, Upstox for opening your demat account, then your changes will be very low compared to full service brokers.

Liquidity:

Stocks are traded in real time in exchanges like NSE, BSE and you can sell the stocks at any time during the market hours and get your money back in a demat account. From the demat account you can redeem the money within a day.

But, in case of mutual funds though the funds are highly liquid the procedures involved in transferring the money to your account takes time. At least it needs five to seven days to get your money from redeeming your mutual funds. So, never invest your emergency corpus or money you may need any time soon in mutual funds even in debt mutual funds. You can consider investing your money in Liquid bees / Liquid ETFs instead.

Accurate Target Entry and Exits:

If you want to invest in a stock at a particular price range, it is possible in stock SIPs. Many brokers allow you to set a target price for entry and execute the transaction automatically. Similarly, Exits can also be done at your set target value. Thus, targeted entry and exits can be executed in Stocks SIP.

In mutual funds, you cannot target an entry and exit. It all depends on the NAV and you can’t even know at what price the stock was bought / sold. All we know is the NAV of the fund which is determined at the end of each day, after settling all the transactions.

Gradual Accumulation of Fundamentally Strong Stocks:

Systematically investing in specific stocks every month allows you to build your corpus in an organic manner and gradually increase your stake in fundamentally strong stocks. Some fundamentally strong stocks like Asian Paints, Hindustan Unilever, Eciher motors, Nestle costs may be difficult to invest for an average investor in one go because of its huge price.

Also, when you buy stocks in SIP mode you have the benefit of Rupee cost averaging, thereby making volatility in stocks to your advantage.

Dividend Income:

One of the underrated things in the Stock market is the dividends you earn from the stocks you invest. You may think that the income you receive from the dividends is too little at times and it has no value.

However, as the time progresses and your portfolio grows bigger and bigger the dividend income you earn will be substantial enough to even meet your monthly expenses. Such is the power of dividend income. However, I personally don’t invest in stocks just to earn more dividends. Dividends, though important, should be only secondary to the values of the stock.

The table below illustrates how dividends can become a significant part of your portfolio in the long run. For example, let us assume a company which gives an annual dividend of 15 INR on average. Let us consider that the dividend income is constant for the entire 10 yr period for easy understanding and the price of the stock is largely unchanged:

| Month | Number of Stocks Purchased through every month SIP | Average Dividend Per stock per year | Total Dividends Earned per year |

| 1 st Month | 10 | 15 | 150 |

| In 20 Months | 200 | 15 | 3000 |

| In 40 months | 400 | 15 | 6000 |

| In 60 months ( 5 year SIP) | 600 | 15 | 9000 |

| 120 Months ( 10 Yr SIP) | 1200 | 15 | 18000 |

You can see that in ten years how a small dividend of 150 INR / year has grown to 18000 per year at the end of tenth year.

Selective Investments in particular Stocks:

Since the SIP and the entire portfolio of stocks is selected by the investors themselves, it is possible to invest more in a particular stock of their choice. If the investor feels that a stock is fairly valued then he / she can invest more in that stock and reduce investing in stocks with falling prices.

But, in debt mutual funds you don’t have the freedom to reduce or increase your stake in a particular stock. The fund manager will decide how much of your investment should go to a particular stock.

Disadvantages of Stock SIP:

Amount needed to start the SIP journey:

Mutual funds SIP is very easy to start as the minimum amount needed to invest in a fund is just 500 INR. With 500 INR you can invest in blue chip stocks like Asian Paints, Maruti, Nestle etc as these stocks can be bought in fractions by the mutual fund houses.

But, in the case of Stocks SIP, you have to purchase a minimum of 1 stock. So, if you want to buy one Maruti share you should invest 7600 INR. These stocks cannot be bought in fractions. So if you select a stock portfolio of ten-fifteen blue chip stocks, then you will need a minimum of 30,000 INR to invest, even if you purchase only one stock. Every month investing such huge money may not be possible for everyone.

Weightage Differences:

In mutual funds, the amount you invest is equally distributed among various stocks by the mutual fund manager. Once your SIP amount is debited from your account, rest is taken care of by the Fund Manager. They allocate the funds to the respective stocks according to the weightage of their model portfolio.

But in the case of Stock SIP, you have to invest in such a way so that all the stocks are equi- weighted and an equal amount is given to each stock for proper diversification.

For example, if you plan to invest 20,000 INR in your stock portfolio that consists of 5 stocks, you have to invest in such a way that each stock gets equal importance. If one stock is given more weightage than the other then your diversification may not be proper.

| Stock name | Price per stock | Amount to be invested for each stock | Amount that can be invested approximately | Quantity |

| Kotak Mahindra | 1792 | 4000 | 3584 | 2 |

| Tech Mahindra | 1429 | 4000 | 4287 | 3 |

| SBI Life insurance | 1080 | 4000 | 4320 | 4 |

| Hindalco | 606 | 4000 | 4242 | 7 |

| Larsen & Toubro | 1752 | 4000 | 3504 | 2 |

From the table above, we can see that five stocks are selected and are planned to invest 4000 INR in each stock thereby getting a monthly SIP of 20,000 INR. However, it is evident that we cannot invest exactly 4000 INR in each stock since the prices of a stock vary. Also, getting a perfect equi-weighted portfolio is not possible. However, we can try to get a portfolio as equi-weighted as possible. This problem can be solved by the Smallcase platform, which allows the automation of creating an equi-weighted portfolio.

Stock Selection:

The most difficult part in Stock SIP is selecting the stocks in which you should invest. The vast options available creates lots of confusion among the investors and it is very difficult to narrow down the stocks you can invest systematically. Currently there are around 1300 securities in the NSE to trade / invest. Selecting a basket of 10-15 stocks from this vast universe is itself a big task.

In Mutual Funds, the stock selection process is taken care of by the fund manager and you need not worry about it.

Needs Expertise:

As discussed above, right from selecting stocks, executing the trade, holding the stock and exiting the stock if it’s not working in your favor, you need some knowledge about the stock market. Blindly starting to invest in a basket of stocks just because you saw a great news about the stock or your relative / friend has recommended the stock or some youtuber has said that investing in a particular stock will give 200 X returns in three years and so on will be a disaster for your financial wellness. It may shatter your dreams of financial freedom once for all.

You should develop some knowledge about the stock market and read about the stocks you want to invest in and you should have a good reason for buying that stock. Basic fundamental analysis and reading chart patterns to some extent is a must before you start investing in stocks directly.

In mutual funds no expertise is required. Disciplined investing and some knowledge about asset allocation and personal finance is enough to start with.

Psychological Attachment to non performing stocks:

The next big problem is getting tied to the stocks you buy. After all the research made and after accumulating a Stock slowly for years, there is a great chance to get attached to your stock psychologically.

A sense of ownership arises in most of the investors and they fail to take action when needed. Even if they see that the stock is not generating any returns or it is falling down steadily the attachment they have for the stock will prevent them from taking necessary action.

Biased decision making, assuring themselves that the stock will do better in near future, ascertaining again and again that the stock is fundamentally fantastic are all the disadvantages in Stock SIPs. There are investors who still hold the “Yes Bank” Stock thinking that it will recover someday.

Frequent Interruption:

It is very common to see that the stocks in your portfolio won’t give any substantial returns even for months and you see stocks which are not in your portfolio running like anything with huge returns.Very easily investors will be distracted and suddenly they will change from an investor to a trader.

You will be tempted to remove a stock from your portfolio and add the stock which has given huge returns in recent times. After adding that stock to your portfolio it is common to see that the stock you dumped starts rising and the stock you newly added starts to correct. This is how the stock market works.

Stock prices always move in wave form. Never moves in a straight line. Also each stock will have its time before trending upwards. It’s very difficult to maintain this composure when investing. Once you are convinced about the stock you should give enough time for it to perform. Frequently churning the portfolio will be detrimental for your success in stock market.

Portfolio Volatility:

Volatility can be defined as a measure of price movement. A portfolio / stock moving erratically either up or down with substantial changes in price is said to be highly volatile. While the price of the stock / portfolio maintains a relatively stable price range it is said to be low volatile.

Stocks are generally very volatile when compared to mutual funds. You should be able to see the price variation without getting disturbed. Some days the price will go up 10-15% and the next day it will fall 7-9% losing all the gains made the previous day. Always remember that SIP in stocks is for a longer duration and will never work in the short term.

How to Start SIP in Stocks?

Nowadays, most of the brokers allow you to have baskets of stocks to do SIP. Some brokers allowing SIPs in stocks are Zerodha, Angel Broking, Sharekhan. You just have to select a group of stocks you want to invest regularly and put it in a basket. Time of purchase, Quantity of stocks to buy and the amount you want to invest every month can be pre-set and can be changed anytime.

Also, demat account along with bank account and trading account can be opened with banks like HDFC and you can do SIP in stocks. Smallcase is a wonderful platform if you want to do SIP with less effort. Automated equal-weighted portfolios can be made easily or you can choose from a wide range of readymade stock portfolios available. But, consult your financial advisor before choosing these products.

Key Takeaways:

- SIP in stocks is a recent possibility, (thanks to the software and technology developments) with phenomenal flexibility and freedom to the retail investors.

- Stock SIP should only be considered for a longer time frame SIP in stocks for short term will be of no use unless you have a pro trader mindset.

- Though starting a SIP in stocks is very easy, difficulty lies in your investment plan, strategy and stock selection criteria.

- One should learn at least basic fundamental analysis and develop good knowledge regarding stock market before venturing into stock SIPs

- If you are a new beginner in the Stock market, start with minimal quantity and then once you gain knowledge slowly scale up your positions.

- If you feel that you are not interested in spending time on Stock analysis and you realize that direct stock investment is not right for you, accept it immediately. Mutual funds are a fantastic option available out there.

- Always discuss with your financial advisor before investing whether the instrument you select is right for your financial wealth.