There are a lot of differences between Debt Bonds and Debt mutual funds. Retailers often confuse these and most think both are the same. Though they both are debt instruments and are intended to reduce the volatility in our portfolio, the way these two work have a huge difference. I felt that it is necessary for us to understand the major differences between them and how as retailers we can make use of them to make informed decisions. In this article we will discuss them in detail and in a much simpler manner.

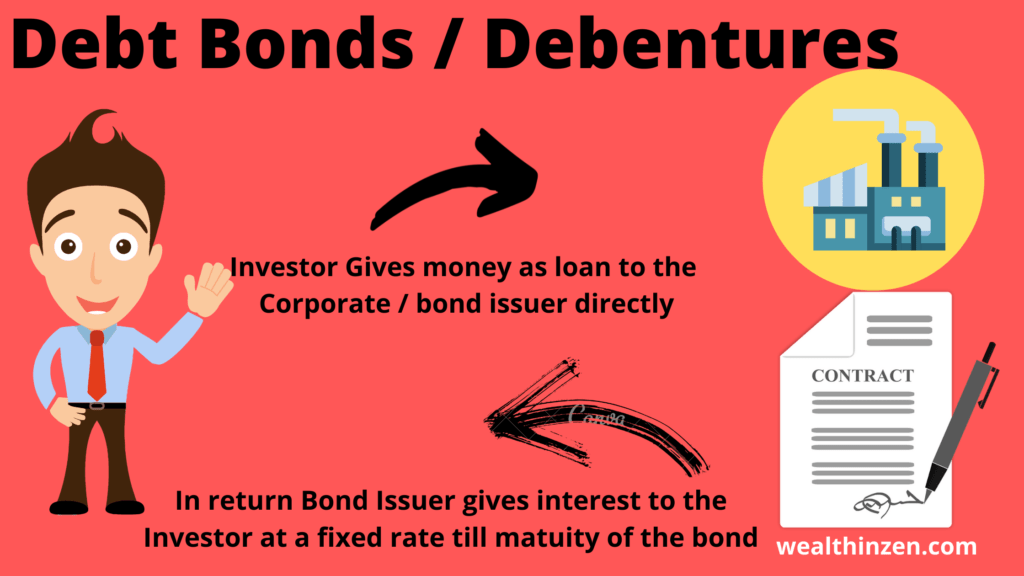

Debt bonds or Debentures are nothing but a debt instrument used by Corporate companies or Governments to raise funds / capitals for their use. The Bond consists of two parties. One is the issuer (Corporate / Government) which issues the bonds and the other is the Investor who gives money to the Bond issuer. In return for the money given by the investor the bond issuer gives them a fixed interest periodically during the tenure of the bond. Also, the issuer promises to give the invested amount to the investor at the end of a specific time called “Maturity Date”.

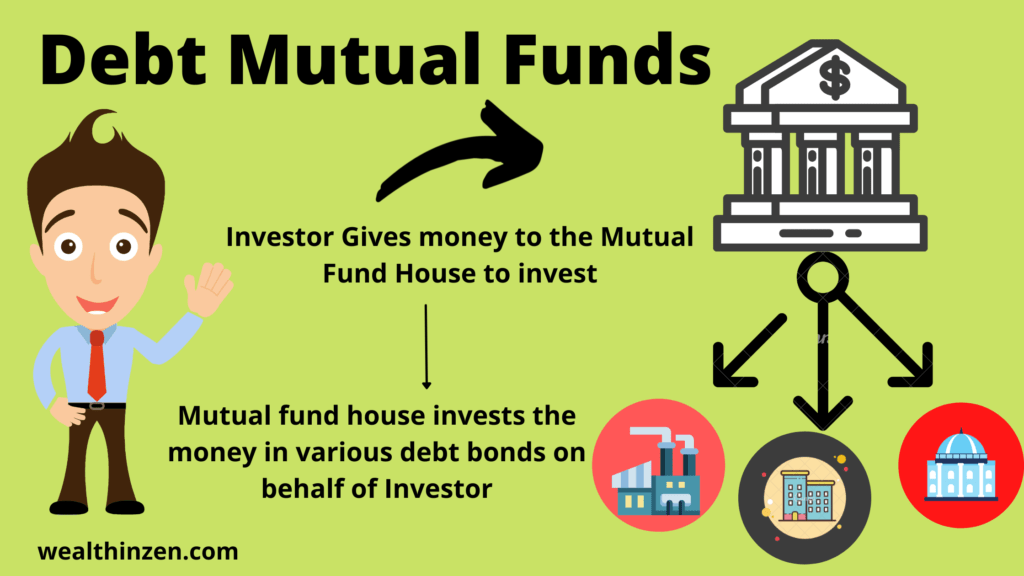

Debt mutual funds are also debt instruments, but here the mutual fund houses like SBI Mutual fund / HDFC Mutual fund / ICICI mutual fund etc., get money from their retail investors and invest them in various debt bonds of different corporations / Public sector / Government securities. Basically the debt mutual fund is a bag containing many debt bonds.

In other words, debt bonds / debentures are a direct contract between the bond issuer and the investor while the Debt mutual funds are a contract between many bond issuers and the investors through an intermediary that is fund houses.

- Investing in Debt Bonds Vs Debt Mutual Funds

- Diversification

- Amount of investment

- Liquidity

- Risks – Credit Risk / Interest Risk

- Expense Ratios

- Interest payouts

- Returns received

- Taxes in Debt Bonds Vs Debt Mutual Funds

- What’s good for me?

Investing in Debt Bonds Vs Debt Mutual Funds:

Debt bonds are usually bought on the day of issuance. The bond issuer advertises the bond issuing date and there will be a specific time to buy the bond, say for example 5-10 days. Within these days these bonds will be for sale and retailers can buy the bonds by investing their money. The coupon rate (interest rate) and the frequency of interest payout (monthly, quarterly, Yearly) and the maturity periods will be informed prior. This is called Primary market buying that occurs in the form of IPO / Initial Public Offerings.

Some bonds may also be available in secondary markets. That is if the investors who bought the bonds want to sell it before maturity they can do so in secondary markets like NSE, BSE just like stocks. Here the transaction occurs among the retailers and company that has issued the bond has no role in it.

Debt Mutual Funds are usually bought and sold in secondary markets. The fund houses can buy the bonds and sell it anytime instead of a specific time as in case of bonds. There will be no need to wait till maturity period to redeem the amount. This makes the retailers not to wait for a particular time to invest in debt instruments.

Diversification:

As said already, the debt mutual funds invest in a variety of bonds like government security bonds, PSU bonds, corporate bonds and so on. So, the money invested is well diversified. Even in case of default by any corporate company the loss is very small and limited to the extent of the investment in that company.

But in the case of debt bonds there is no diversification. You invest in a single company bond and in case of default of the company the entire investment amount is at risk. Diversification by debt mutual funds is an advantage to avoid volatility in our portfolio and to minimize risk.

Investment Amount in Debt Bonds Vs Funds:

The amount to be invested in a Debt Bond is usually very high. You should invest at least a lakh to buy a bond. Very few public undertakings may allow lesser amounts of 10000 also, but it is very rare.

But in a debt mutual fund, you can invest even a very small amount of 500 INR to start with. This gives retailers a great opportunity even with average income to invest in debt instruments. Also since the debt mutual funds can be bought and sold any time, SIP (Systematic Investment Plan) is a wonderful option to the investors.

Liquidity Of Debt Bonds Vs Funds:

Bonds issued by the company usually come with a lock in period. You have to wait till maturity (ranges from 1 year – 10 years) to redeem your principal amount. In case you need money in the middle it is not possible to redeem.

However, very few bonds will be listed in stock exchanges for trading. This is called the secondary market and here you can sell your bond to another willing buyer. But the problem is if during the time at which you sell your bond the interest rates are higher your bond value will be very less and hence carries a risk of interest risk. So, if you are planning to buy a bond it’s better to hold it till maturity.

Debt mutual funds on the other hand are highly liquid. The entire transactions occur in the secondary market, mediated by the fund houses through which you invest. Redeeming is very easy and is just a click away. You can redeem the amount you need at any time without breaking your head.

Risks Involved:

Credit Risk:

The most common risk of debt bond is the credit risk. This means if the bond issuing company goes bankrupt or if they are unable to repay the loan due to losses or in the case of any black-swan event then the investor’s money is at risk. One way to avoid this is by buying bonds of companies with good credit ratings.

But it also does not guarantee anything. A recent example is the Dewan Housing Finance Corporation (DHFL) default on repayment of 50 crore worth of bonds to the investors. DHFL was having a credit rating of AA meaning good safety just a day before filing bankruptcy. Within a day the rating degraded to “D” meaning default.

In debt mutual funds also the credit risk is there. But since the funds are diversified and invested among different companies, even if any one company goes default, its effect on portfolio will be lesser and proportionate to the allocation of funds to that particular company only.

Interest Rate Risk:

Debentures / Debt Bonds are usually not affected by changes in interest rate. This is because the coupon rate (Interest rate payout) is fixed. But this applies only when the investor buys the bond directly from the company (primary market) and holds it till maturity date.

However, if the investor sells it in the secondary market in the middle of the maturity date then he may either incur a loss or a profit depending on the interest rate on that day and its corresponding effect on the bond value. Note that not every bond can be sold in the secondary market. If your bond is not traded in the secondary market (NSE, BSE) then you have to hold it till maturity.

On the other hand, interest rate risk is high in case of debt mutual funds. This is because all the transactions occur in the secondary market. Some will be investing and some will be redeeming on the same day and the bond prices will vary depending on the day of investing / redeeming according to the interest rates prevailing that day. Bond value has an inverse relation with the interest rates. Higher interest rates reduce the bond rate and vice versa. At times it is possible for debt mutual funds to give even negative returns when invested for a very shorter period of time.

Expense Ratios:

An Expense ratio also called as Management expense ratio (MER) or Total expense ratio (TER) can be defined as a measure which tells us how much the assets of the Fund is being used for administrative and other operative expenses. Expense ratio varies for different types of fund and is not a fixed value for all funds.

Debt bonds are a direct contract between you and the bond issuing company.There are no expense ratios associated with this since there is no fund house or fund managers involved.

In the case of Debt mutual Funds, there is a fund house and a fund manager who manages the amount you invest. So, there are operational charges, transactional charges when the manager buys and sells the bonds, advertising and marketing fees etc. The expense ratio varies from 0.8% to 2 % depending on the type of debt funds and AUM of the Fund. Selecting a debt fund with too high expense ratio may hamper your return in the long term.

Interest Payouts:

Debt bonds have a coupon rate that is specified at the time of buying the bond and the interest payout frequency will also be mentioned. That is it may be monthly, quarterly, yearly or cumulative. The specified interest will be deposited to your account in the specified time. This interest payout will continue till you hold the bond or till the maturity of the bonds. Thus you will be receiving an amount at the fixed interest rate periodically.

In debt Mutual Funds, the interest is credited to your account periodically by opting for Income Distribution Cum Capital Withdrawal plan (ICDW) Plan which was previously called as DIVIDEND Plan. Or you can opt for a Growth plan. In the Growth Plan, your interest will be reinvested and used to buy more units. This in the long term may give you a good compounding return. Remember that compounding is because of the increase in units you buy and there is no compounding interest in the plan.

Returns received:

In debt bonds the interest earned is of simple interest, that is a fixed rate of return on your initial investment. This should be understood properly. Many investors are attracted by the high interest rates these bonds give them without knowing that it is a simple interest. What you get in your Bank FD is a Compounded return. That is why bond issuers use a term called Annual Yield which simply is the interest they pay out periodically.

For an understanding let us see an example with an investment of 1,00,000 in a Debt Bond with coupon rate 8% and Bank Fixed Deposit with an Interest rate of 7%. Both the interests will be paid annually and the time period of investment is for six years.

| Year | Amount Invested | Debt Bond with coupon rate 8% – Interest Earned (Simple interest) | Bank Fixed Deposit @ 7% interest Compounded yearly |

| 0 | 100000 | – | – |

| 1 | 100000 | 8000 | 7000 |

| 2 | 100000 | 8000 | 7490 |

| 3 | 100000 | 8000 | 8014 |

| 4 | 100000 | 8000 | 8575 |

| 5 | 100000 | 8000 | 9175 |

| 6 | 100000 | 8000 | 9817 |

| Final Amount Received | 1,48,000 | 1,50,071 |

You can see that even though the debt bond offered a coupon rate of 8% higher than the Bank Fixed Deposit, at the end of sixth year the final amount received before tax is greater in Bank FD than a Debt Bond. This is because of the simple interest paid by the bonds while the interest from a Bank FD is compounded.

In Debt mutual funds, the returns you see is AGR ( Average Growth Rate) and not Annual Yield. However, here also if you opt for IDCW Plan you will get simple interest only. But, if you opt for a Growth plan, though the interest received will be in the form of simple interest only, the amount received from the interest will be reinvested and you will get more units. So each year your units will be getting compounded. More the units more the returns. So, in debt mutual funds I always prefer to invest in Growth plans. But, never invest in a mutual fund just by seeing CAGR returns.

Taxes:

In debt bonds the interest is given to the investors periodically. The interest earned is calculated as income from other sources and is taxed as per the income slab of the individual.

The same applies to debt mutual funds with IDCW Plan which pays interest to the investors account periodically.

But in case of Debt Mutual Funds with Growth option – the profits earned will be considered as Capital Gains. If you are redeeming the funds within three years of investment it is called Short Term Capital Gains (STCG) and is taxed as per the income slab of the individual. If the redemption occurs after three years it is called Long Term Capital Gains (LTCG) and is taxed 20% with indexation benefits (adjusted to inflation).

What is good for me?

It should be clear now that Debt bonds and Debt mutual funds work in very different ways and each have their own advantages and disadvantages. While Debt Bonds have more credit risk, Debt Mutual funds have more interest rate risk. One way to avoid credit risk in Debt Bonds is to buy Gilt Bonds (Government Securities Bonds) but they usually have a longer maturity period and are difficult to redeem before maturity.

In my opinion, if my net portfolio is not more than 20 Lakhs I won’t consider debt bonds. I will instead consider debt mutual funds which have more diversification and a fund manager to manage my money. Also debt mutual funds can be redeemed any time without breaking the head.

But, if your portfolio is big and you don’t mind taking some added risk and don’t need money in the near future then considering debt bonds will make sense.

After all, the main focus of investing in debt instruments should be to avoid risk and volatility in our overall portfolio and to give us a balance with equity investments. Therefore going behind debt bonds without understanding it in true sense can burn your fingers.

Debt bonds can give you better returns than debt funds if invested in a proper way. If you don’t understand much about debt bonds, how it works and how to manage it if any crisis arises then better stick with Debt mutual Funds. Consult with your financial advisor which suits you better before investing your money.

Table of differences- Bonds Vs Debt Funds:

| Criteria | Debt Bonds | Debt Mutual Funds |

| Investment Type | On the day of issuing Bond in primary market mostly | Secondary market |

| Investment amount | Usually Large at least 20000,most bonds require a Lakh to start with | Minimal amount of 500 is enough |

| Diversification | Not Applicable | Yes – five to six bonds in a single fund |

| Liquidity | Difficult to redeem before maturity | Easy, anytime |

| Risks | Credit risk more than Interest risk if the bond is held till maturity | Interest risk more than credit risk |

| Interests Payout | Simple interest | Simple interest only but the amount is re invested to buy more units thereby giving a compounding effect |

| Taxes | As per income slab | If redeemed within 3 years – as per tax slab. After 3 years – 20% with indexation benefit |

Very nice Article

Thank you for the reply. Subscribe to our newsletter for regular updates