When you are waiting for the right time to enter the market and you have a large amount of cash sitting idly in your brokerage account, have you ever thought of what to do with money? Transferring the idle money to your savings account and then transferring it back to the brokerage account when you want to is not that easy particularly when the portfolio is big. Taxation and transaction costs may be unnecessary.

What if you can get a decent return somehow similar to a savings account and at the same time you can keep the money in the demat account safely invested? What if you can take the money any time of the day and can use it on the same day for trading / investing? If you are looking for an answer then Liquid ETFs can be a great alternative for you.

“ Liquid ETFs / Liquid bees are debt oriented Exchange Traded Funds that invest in Government securities and Treasury Bills (A short term Govt Backed debt obligation) backed by the Reserve Bank of India. They combine the benefit of having the flexibility of the stock market and simplicity of mutual funds with returns of 3-4% similar to savings accounts. It is suitable for anyone who wants to park their excess money for a short period of time( 1 week -3 months).”

- What are liquid bees / Liquid ETF?

- Who should invest in liquid ETFs?

- Where and How to invest in Liquid ETFs?

- How Liquid ETFs work?

- What return can I expect in Liquid ETFs ?

- Dividends in Liquid bees

- Taxes in Liquid Bees

- Expense ratio in Liquid Bees

- Other Charges In Liquid Bees

- Liquid Bees as a collateral or margin in Futures and Options Trading

- Liquid ETFs or Liquid Debt mutual Funds?

- Key Takeaways

What are Liquid bees / Liquid ETFs?

Liquid ETF which is governed by Nippon India is called Liquid Bees. Since until recently, Nippon India was the only fund offering this investment option the word Liquid Bees has become indifferent with Liquid ETF. Now, we have other Liquid ETFs like DSP Liquid ETF and ICICILQ similar to Nippon ETF Liquid Bees. Hope this point is clear.

Who should invest in Liquid ETFs?

- Liquid ETFs are best suited for people who trade frequently. Imagine, you are a person who predicts that the market is going to be in downtrend for a few months from now and you want to book profits and re-enter the market after two to three months once the market corrects to a good extent. But at the same time you want to keep the money in your demat account itself till the right time comes. You can just buy Liquid bees and sell them when you need money for investing in equities.

- If you are a Futures and Options trader you can use the money invested in Liquid bees as a collateral or margin. (We will discuss this later in this article)

Where and How to invest in Liquid ETFs?

Liquid ETFs are traded in exchanges (NSE, BSE) just like a stock. You can just go to your demat account like Zerodha, Upstox, Sharekhan and search for Liquid ETFs and then buy the ETFs at the market price. You can sell the ETFs in the same way.

How Liquid ETFs work?

The way it works is somehow different. The price of liquid bees remains constant, that is 1000 per unit. The returns you earn daily are credited to your account at the end of month in the form of units instead of money. You can understand this easily with the following flowchart example:

What return can I expect in Liquid ETFs?

Liquid ETFs are meant for short duration only. Since they invest only in Government securities the risk involved is low and thereby the returns are also lower. The average return you can expect is around 3-4% per year which is somehow similar to the returns you get from a savings account. Sometimes it may be lower than the savings account returns also. Remember that this is not an investment option for a long term. You are just parking your excess amount which you are not ready to invest at that time in Liquid Bees for some days to weeks.

For you to understand below is the table (Source: value research) that gives us the historic return values of Nippon ETF Liquid Bees and DSP Liquid ETF

| Fund Name | Launch date | 1-Year return | 3-Year return | 5-Year return |

| Nippon India ETF Liquid Bees | July 2003 | 2.45 | 2.85 | 3.79 |

| DSP Liquid ETF | March 2018 | 2.70 | 3.62 | – |

Dividends in Liquid Bees:

In Liquid ETF funds the dividends are paid daily. However it is credited to the demat account at the end of every month. The credited dividend is also in the form of units and not as money. You can redeem this when you sell your units Remember that you have to sell a minimum of 1 Unit for redemption. If the units received as dividends in a month is less than a unit you have to wait till it becomes one unit to sell it.

Let us see the historic dividend of Nippon India ETF Liquid Bees for the year 2021 with an example. Let us assume that you invest 1 Lakh in Liquid Bees, you get 100 Units for 1 Lakh (Price of one unit is always a constant = 1000)

| Month | Dividend amount received Per Unit | Dividend amount received for 100 units |

| Jan 2021 | 1.89 | 189 |

| Feb 2021 | 1.79 | 179 |

| March 2021 | 2.13 | 213 |

| April 2021 | 1.95 | 195 |

| May 2021 | 1.79 | 179 |

| June 2021 | 2.13 | 213 |

| July 2021 | 1.54 | 154 |

| August 2021 | 2.02 | 202 |

| Sep 2021 | 1.59 | 159 |

| Oct 2021 | 2.19 | 219 |

| Nov 2021 | 2.1 | 210 |

| Dec 2021 | 2.02 | 202 |

| Total Amount received | 23.14 | 2314 |

| % Of Return Per Year | 2.314% | 2.314% |

The above table tells us that the return of Liquid Bees was just 2.314 %. It is evident that the returns are to be expected even lower than the savings account.

Where can I see the dividends?

You can see the dividends in your holdings only when the dividend units you receive becomes at least 1. For example if you receive a dividend of 0.4 units at the end of a month, you cannot see it in your holdings.

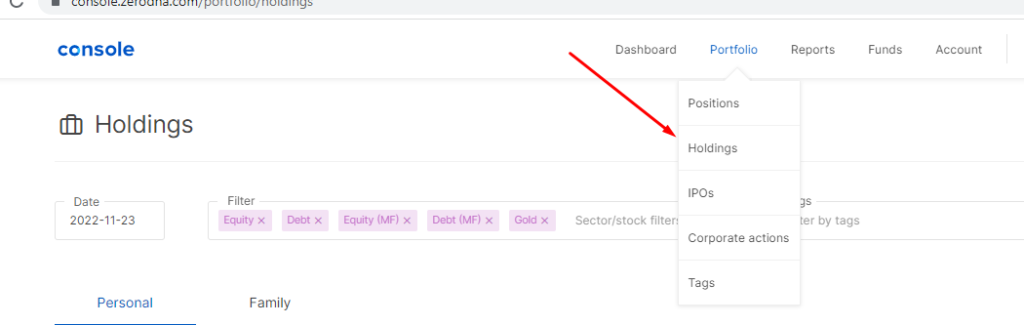

But, however you can see it in the console (In case of Zerodha). Just go to Zerodha console and click on portfolio as shown in the image below and then click holdings:

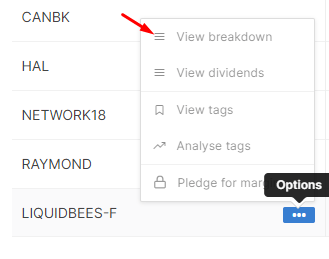

Now, click on the Options shown as three dots next to the Liquidbees holdings and then click view breakdown:

Now you can see all the dividends received as per date:

Taxes in Liquid Bees:

The returns are given to the customers only in the form of dividends. So, the taxation is similar to the taxation of the dividends acquired from the equity shares.

Dividends are considered to be income from other sources. If the dividends received in a financial year of less than 5000 INR no tax will be deducted from the source. If the dividend amount is more than 5000 INR in a financial year 10 % tax will be deducted at source. However, in both cases, the individual person who receives the dividend (either less than 5000 or more) has to show it in their income and will be taxed as per their tax slabs.

For example, if you had bought 1000 quantities of liquid bees and had held it for a financial year. You received a dividend of 25 units in that financial year. Then it means 25*1000 = 25,000 is the gain you received as dividend from Liquid-bees. This will be taxed as per the holding period. If you hold it for a long term, that is more than three years it will be taxed at 20% with indexation benefit and if you hold it for less than a year then it will be taxed at your tax slab rate.

Expense Ratio in Liquid ETFs:

Even though these are simple investments and do not require much expertise the fund houses (Nippon in case of Liquid Bees) have to bear some expenses like transaction cost, advertisement cost, Fund Manager cost. So, it has an expense ratio. This usually comes around 0.65% per year for Nippon India ETF Liquid Bees and 0.63% for DSP liquid ETF.

The expense ratio for a fund like this is very high in my opinion. Because it is higher than the debt mutual funds which requires much expertise for the fund manager to manage funds and the returns are usually way higher than these Liquid ETFs.

If you want to know how expense ratio can affect your portfolio returns in the long run you can read my article here.

Other Charges In Liquid Bees:

Though these ETFs are bought and sold just like a stock in a demat account, there will be no STT tax, exchange transaction charges, stamp duty. Also in most of the discount brokers like Zerodha, there is no brokerage charges also. However, when you sell the ETFs your broker will charge you a Depository Participant charge (DP Charges) which will be usually less than 20 INR irrespective of the units you sell in a single day.

Liquid Bees as a collateral or margin in Futures and Options Trading:

The most important advantage of Investing in Liquid Bees is that you can use that money as a margin for trading in Futures and Options segments.

Suppose, you have invested 10 Lakhs in LiquidBees and you are taking a trade in futures segment which requires 10 Lakhs in your demat account. Then, instead of having an extra 10 Lakhs in demat account you can use 90% of the amount you invested in Liquid Bees as a collateral. That is 9 Lakhs for your trade will come from Liquid Bees while only 1 Lakh you have to show in your account.

If you are a trader who trades regularly this will be helpful as the amount invested in Liquid Bees will be giving you a 3% return in form of dividends and at the same time you can use that money as a collateral for your trading.

Liquid ETFs or Liquid Debt mutual Funds?

The major difference between Liquid ETF and Liquid debt mutual fund is that you cannot buy the latter in exchanges just like a stock. You have to buy it through a mutual fund AMC.

Let us see a small comparison of Nippon ETF liquid Bees with two Debt funds

- SBI Magnum Ultra Short duration Direct Fund

- ABSL Liquid Direct Fund

And a liquid ETF similar to Liquid Bees that is DSP Liquid ETF

The graph above (Source – Value research) clearly shows that the CAGR returns of the debt funds are clearly higher than the Liquid ETFs. Also the expense ratio for these funds are lower which is around 0.28-0.35% when compared to Liquid ETFs -0.63-0.65%

| Fund Name | Color of Line in Graph | CAGR for 3 Years in % |

| SBI Magnum Ultra Short duration Direct Fund | Pink | 5.76 |

| ABSL Liquid Direct Fund | Orange | 4.72 |

| DSP Liquid ETF | Light Blue | 3.64 |

| Nippon ETF liquid Bee | Dark Blue | 2.85 |

It is clear that if you are not a trader and you don’t know market timing and all it is better to invest in debt liquid funds which are way better than Liquid Bees. On the other hand if you are a trader in F & O Segment and you are nimble in taking trades you can invest in Liquid Bees and use it as a collateral.

KEY TAKEAWAYS:

- Liquid ETFs are traded directly in exchanges and can be bought like a stock

- Price of Liquid Bees is always kept constant to 1000, Any increase in price will be given to investors as dividends in form of units

- Can be used to park your emergency fund which you may need in a week or a month

- If you are a Futures and Options trader you can use it as a collateral or margin for your trades.

- Risk is low as it invests in government securities and at the same time returns are also low

- It’s better to invest in Liquid / Short duration debt mutual funds than to invest in Liquid Bees / Liquid ETFs as the returns are better in the former.

- Consult your financial advisor whether this is a good investment option for you.

3 thoughts on “Liquid ETFs / Liquid Bees- Should you invest? Taxes and Dividends for Liquid Bees – A Complete Analysis”