Do you know that most of the retail investors select their mutual fund based on the CAGR / Compounded Annual Growth Rate that is given by the fund managers? Whenever you are searching for a mutual fund to invest in, the most common thing that is being shown up in the performance of the fund is the CAGR . We see the past performance and tend to invest in funds that have the highest CAGR. However, investing in a fund / asset only on the basis of CAGR can be very dangerous if you don’t know what it actually means. We will see how you can understand the CAGR well and make informed decisions in your investments.

What is CAGR?

Compound Annual Growth Rate (CAGR for short) is a financial term that measures the mean annual growth rate of an investment over a given period of time. It helps to compare the growth of our investment with other investment options like FD, RD or any other assets. Though it seems to be similar to the average annual growth return (AAGR) it differs in the fact that CAGR also includes time as a major factor in it.

How CAGR is calculated?

Formula to calculate CAGR –

CAGR = (Beginning value / Final Value)^ 1/n – 1 X 100

“n” is the number of years invested

To calculate the CAGR of an instrument

- Divide the value of an investment at the end of the period by its value at the beginning of that period.

- Raise the result to an exponent of one divided by the number of years you have invested.

- Subtract one from the subsequent result.

- Multiply by 100 to convert the answer into a percentage.

What does the CAGR Tell You?

The compound annual growth rate is just a representational figure rather than a true return rate. It is essentially a number that describes the rate at which an investment would have grown if it had grown at the same rate every year and the profits were reinvested at the end of each year.

However, In reality, this sort of performance is unlikely. Because the market is highly volatile (moves up and down). But, the CAGR smoothens the returns so that it can be more easily understood compared to alternative methods. It is also very informative compared to AAGR (Average Annual Growth return).

Example of calculating CAGR:

Imagine you invested 50000 in a portfolio with the returns as mentioned below:

| Year | Amount | Return percentage | |

| 0 | 2017 | 50000 | |

| 1 | 2018 | 60000 | 20% |

| 2 | 2019 | 67000 | 11.6% |

| 3 | 2020 | 54000 | -19% |

| 4 | 2021 | 72000 | 33% |

We can see that on an annual basis, the year-to-year growth rates of the investment portfolio were quite different as shown in the parentheses. On the other hand, the compound annual growth rate smooths the investment’s performance and ignores the fact that 2020 was vastly different from 2019 and 2021. The CAGR over that period was 9.54% and can be calculated as follows:

CAGR = (50000 / 72000)^¼ – 1 x 100 (4 is the number of years invested)

The CAGR of 9.54% over the four-year investment period can help an investor make an informed decision of whether to invest in the asset or not. Also using this value as a reference he can compare with other asset values like returns of FD, RD or other mutual funds also. The investor can forecast how the future returns can be most likely.

What CAGR does not tell you?

Although CAGR tells us the past performance of a fund / asset in a given period of time, it does not tell us how the price fluctuates each year and the ups and downs our investments underwent those times.

Let us understand this with the following example,

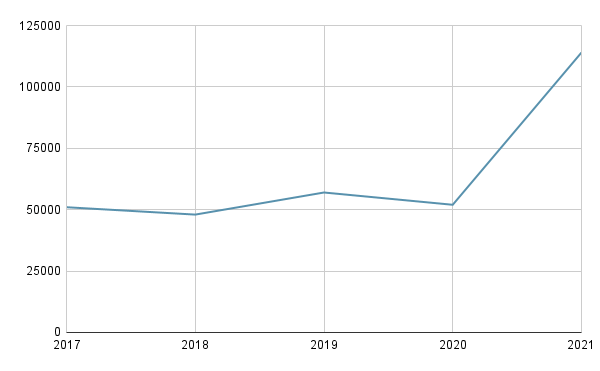

Imagine a well known mutual fund that invests completely in equity has a CAGR of 17.92% for the past five year duration. Any normal retail investor would be very happy about this very decent return in comparison with the Bank Fixed Deposits. You would be tempted to invest in that without having much doubt. But let us see how the rolling returns (Calculated each year) of the fund was and how much the investment money moved up and down each year

| Year | Amount | Return Percentage | |

| 0 | 2016 | 50000 | |

| 1 | 2017 | 51000 | 2% |

| 2 | 2018 | 48000 | -5.8% |

| 3 | 2019 | 57000 | 18.75% |

| 4 | 2020 | 52000 | -8.7.% |

| 5 | 2021 | 114000 | 119% |

In the above example, the CAGR for five years is calculated as follows :

CAGR = (50000 / 114000)^⅕ – 1 x 100 (5 is the number of years invested)

which is 17.92%

As per the definition this number represents that the initial amount invested grew each year 17.92 % which is absolutely misleading. You can see that the most of the returns were made in the last year – a staggering 119% which helped in making the CAGR to a decent 17.92%.

If we leave the last year data and calculate the returns for four years instead of five years, the CAGR would be 0.99% only. Not even 1%. Imagine how painful it would be to get a return like that way less than your normal Fixed Deposits, which usually gives at least 5-7% each year with compounding.

“In the above graph you can clearly see how your investment was not moving anywhere till 2020 but in the last year 2021 it has moved 119% making the CAGR to 17.92%”

Limitations of CAGR:

It gives only a smoothed rate of return ignoring the volatility thereby giving a false impression that the returns were steady. However, market returns are wavering and the prices move up and down always and never in a straight line.

It does not take into consideration whether the investor adds funds to a portfolio or withdraws funds from the portfolio over the period being measured.

For example, if an investor had a portfolio for five years and injected funds into the portfolio during the five-year period, then the CAGR would be inflated. The CAGR would calculate the rate of return based on the beginning and ending balances over the five years, and would essentially count the deposited funds as part of the annual growth rate, which would be inaccurate.

This is the reason why your portfolio’s CAGR will not be the same as shown by the fund management company for the same period.

You cannot use CAGR as a measuring tool if you are investing in a systematic plan. For that you have to use XIRR – Individual Rate of Return.

Fund managers may omit the important details of the fund’s history including the fact that the CAGR in the first four years (as in our example) was pathetic @ just 0.99% and lure the customers with the CAGR of 17.92%.

What can be done?

As we are aware how the CAGR works and how it can mislead us it is necessary we should see the returns of a fund /stock/any other asset for each year. If the returns are somehow consistent and less volatile (less aggressive up and down moves), the fund can be considered safe.

We can get these details in any websites related to finance like moneycontrol.com / Value research / economic times etc.,

Always have your expectations under control and learn that markets were / are and will be volatile only. Your investments will go to negative zones for some years and suddenly in one single year your profits will sky rocket. Make sure, how long you want to invest and consult a financial advisor to get to know which mutual funds will be suitable for your income stream and goals.

Key Takeaways:

- The compounded annual growth rate (CAGR) is one of the most accurate ways to calculate and determine returns for anything that can rise or fall in value over time.

- Investors can compare the CAGR of two alternatives to evaluate how well one stock performed against other stocks in a peer group or a market index.

- It is not suitable to measure the returns in case of systematic investments where you invest at regular intervals.

- The CAGR does not reflect investment risk, so never invest in a fund / asset blindly just because their fund managers are claiming a very attractive CAGR.

If you are a beginner in your investment journey you can see what you should do first before investing check out here

I will immediately grab your rss as I can not find your email subscription link or newsletter service. Do you’ve any? Kindly let me know in order that I could subscribe. Thanks.

Hello thanks for that. You can subscribe me in the site itself. You can see the subscription link on the sidebar. Let me know if you need any help.