Hi all,

Hope you are doing well. I am publishing all my trade journals for reference from time to time. Though I am a little lazy in publishing, I am doing my best to upload the content as soon as possible in the coming times.

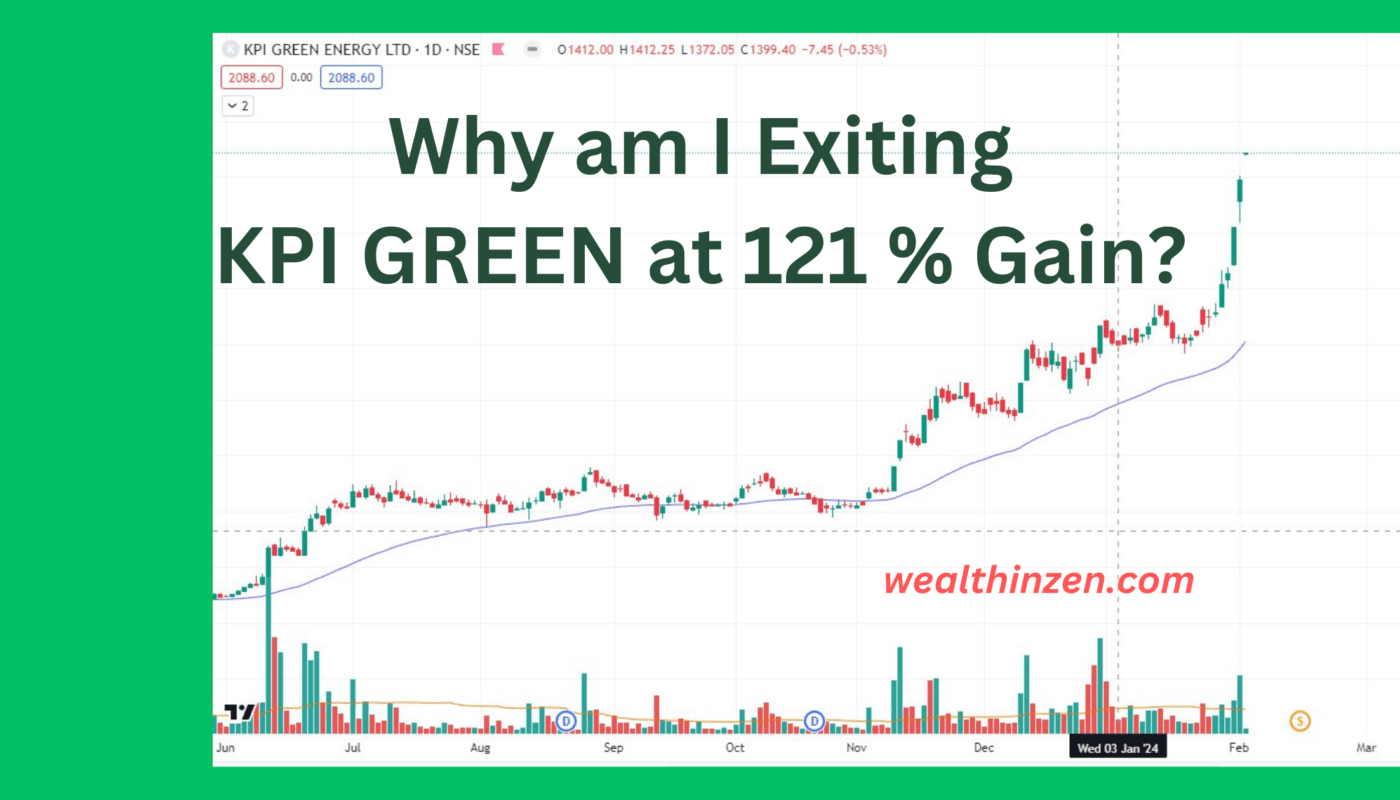

In this trade Journal, I am discussing my trade of KPI GREEN that I took in NOV 2023 and why am I exiting the stock today at a gain of 121%. Use these journals just for reference for your trades. You may think me as a genius (as I booked 121% gain) or an idiot (as it may run another 200% also from here). It all depends on how you trade and what psychology you have. There is nothing to judge anyone here.

So let’s go on to the trade:

I took the trade on NOV 09 – 2023.

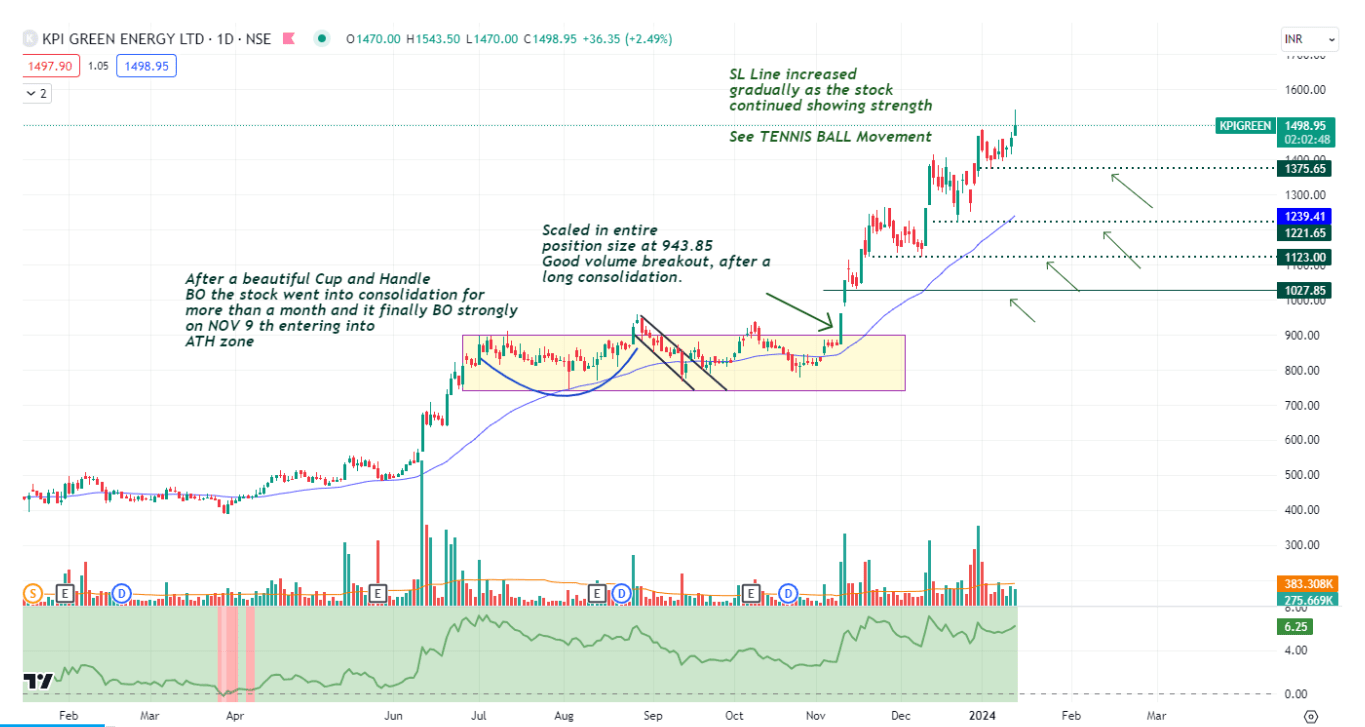

After the cup and handle breakout I was keenly watching the stock on my watchlist.

The stock went on consolidating for a good period of time. But, note that the stock never come down to touch the initial base.

Each time it came down in consolidation phase, it was well supported by 50 DMA and also there was a small HH HL formation in the chart. This gave me more confidence. Also during consolidation it showed some gap up days. I love stocks that gap up during consolidation. Powerful sign of accumulation.

To visualize the gap day, you can go to your charts and check them. (Nov 3rd 2023).

So at last it gave an entry on NOV 9, Superb volume and strong green candle breakout.

On that day the broader market was not that decisive. But, I go behind leaders that breaks out before the market.

Weekly chart of KPI GREEN:

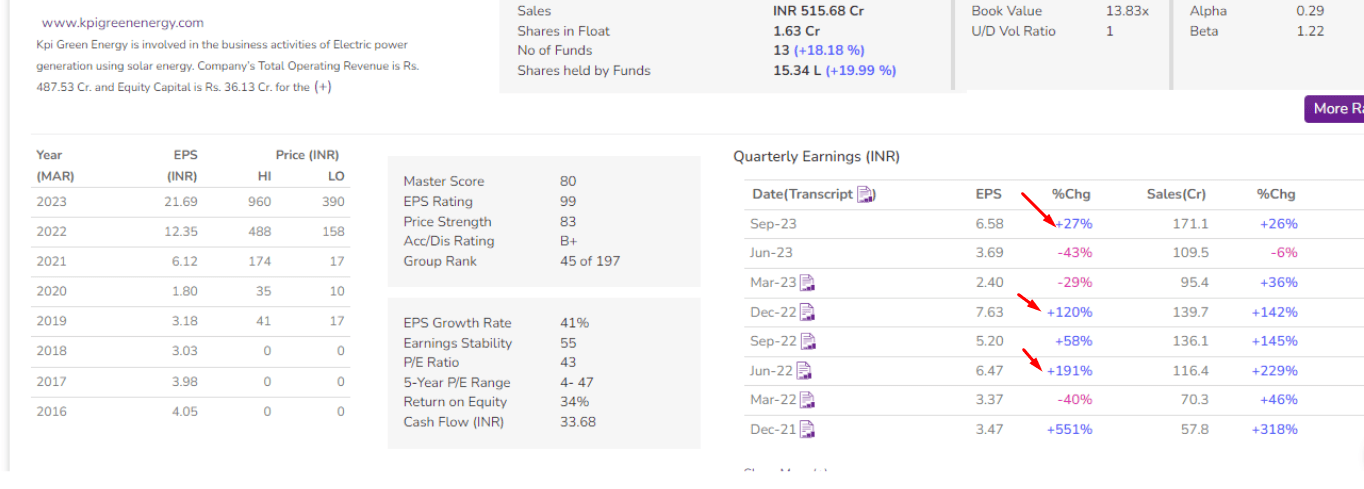

Fundamentals:

I can’t say that the fundamentals are superb, but not bad at all. See the sales column, the sales has increased tremendously in some quarters:

As the stock moved up and up, I constantly increased my SL Line. See the arrows pointing to the new SL pivots.

Then the stock moved like anything and went too extended from 50 DMA.

Also, the buying is so crazy and may be impacted by the budget announced on FEB 1.

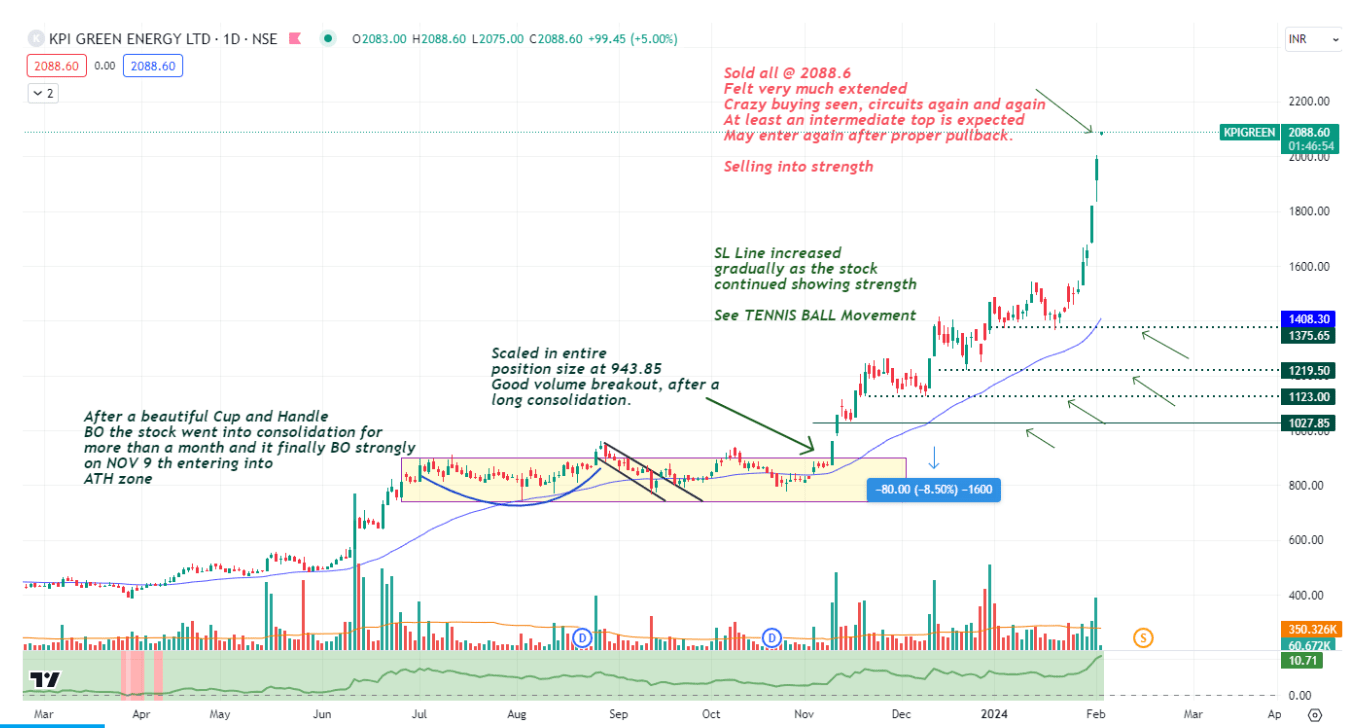

I am selling this stock for the following reasons:

Superb move of more than 121% within three months from the purchase date.

Booking profits occasionally gives me confidence and also improves my trading psychology.

This stock often goes to upper circuits. With a gain of 121% what if the stock goes down into back to back lower circuits for two to three days? Then my overall profit will come down to 60-70% also.

I want to avoid unnecessary drawdown by controlling my greed and also understanding that stock movements are not linear.

See the chart below:

It seems to be an exhaustion gap as Mark Minervini explains. Also see the volume today (Feb 02-2024). Poor volume. Gap with the poorest volume in recent days is concerning me.

Point to note:

I clearly understand that the stock may run again another 50-60% or more also. But that does not matter to me.

This is not selling due to fear of missing out which I did in ANGEL ONE Trade. Read that. In that, the stock had run up only 25-35%, but here it has run up 121% from my buy point.

I also understand that this stock might be in a multi year bull run. So, It will be in my watch list and when proper pull back and consolidation occurs I will again scale in with proper entry and exit rules without hesitation.

How to make a perfect trading journal to make money consistently in Trading?

READ HERE…..

If you are holding this stock don’t sell just because I did so. I may be completely wrong and might have exited pre maturely also. Follow your sell rules. Your rules are yours only.

Happy trading !!!