Hi all !! Hope all are doing fine. You all know that I keep writing about my trades under the heading “ Trading Journal Series” (both winning and losing trades) often. My aim is to keep a track of all the trades I am taking irrespective of its outcome and style. I do this to reaffirm my rules and to get clearer day by day. I also post my losing trades and trading mistakes. I do it, so that I can get better and improve my winning skills in the coming days.

This article is about a trade ANGELONE that I took on JUNE 30 2023.

FOMO is of two types. One is fear of missing out on the swift move of stocks and ending up in buying over extended stocks and the next FOMO is fear of losing out the profits. This trade is of the latter, where I booked my profits too soon before my selling criteria met.

I took this trade at the last day of the month as the monthly chart closed stronger. See the monthly chart below:

Weekly chart is shown below: You can see the small cup that formed and then broke out the previous pivot with good volumes and RS turning positive.

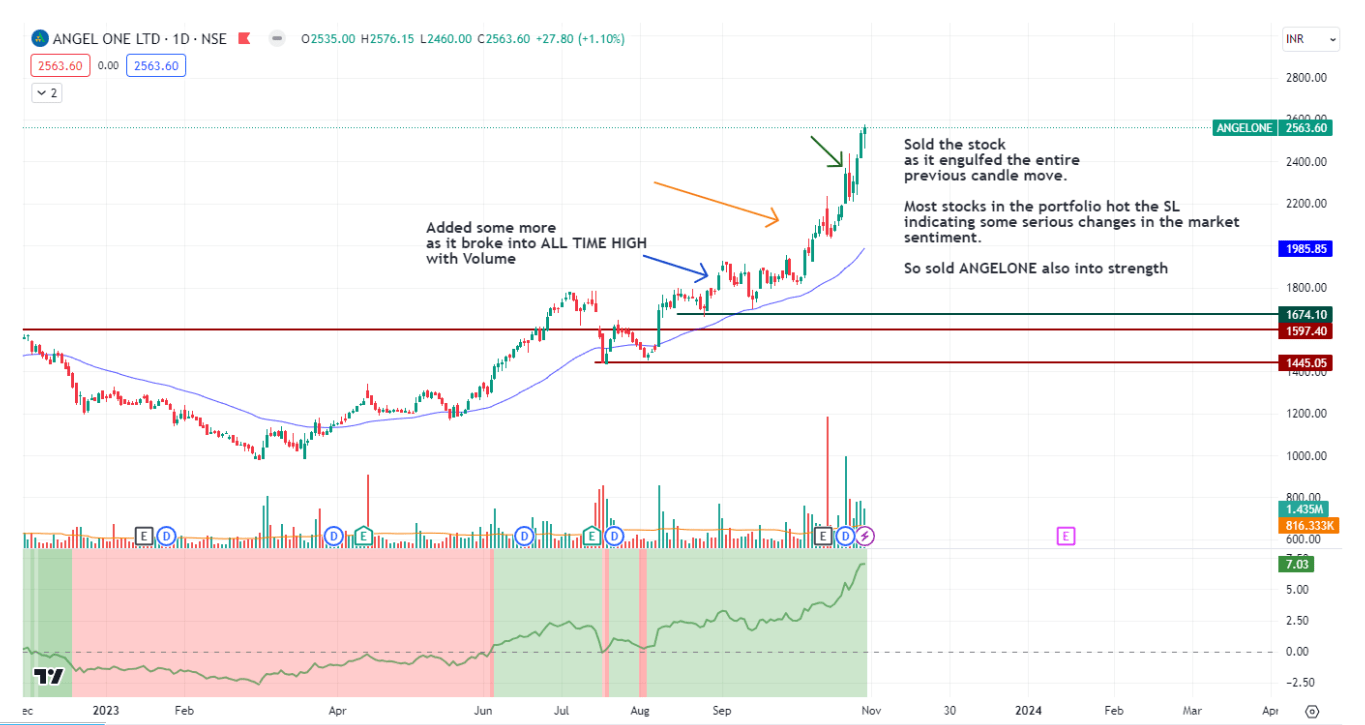

See the daily chart below:

Within a few days of buying, there was a severe gap down with volume picking up downside. SEBI has penalized ANGELONE for some non compliance issues.

Panic selling was visible. The stock broke down 50 EMA with the highest volume ever. However, since the sell down is on some bad news it may be a knee jerk reaction. So, I waited for a day to see what happens after that.

Immediately at the 50 EMA, buying power overtook and raised the stock higher with follow throughs. Later, that point was kept as the new stop loss (ORANGE ARROW) and decided to exit the stock if it breaks down the pivot.

As the stock showed strength, I kept on adding as it went up and up. Also see the biggest red volume bar (Orange arrows). These things can be scary when seen in real time. However, multiple time frame analysis gives good confidence. I had written an article on how to do volume analysis using multiple time frames, you can read that.

As you can see below, the stock moved fast after that huge red volume also.

I was enjoying the ride, till that time and suddenly something happened in the broader market. Small cap showed some downward trajectory with two big red candles within a span of a month.

While on the first fall of SEP 12 my portfolio held up strong, on the day of the second fall, my portfolio witnessed a fall of more than 3%. Most of my running profitable trades hit the trailing stop losses. Also NIFTY 50 went below 50 DMA with strong close on downside.

The next day I sold out the entire position of ANGELONE at a total profit of 25%. Funny part is after I sold it the stock came back strongly and closed the day with a huge tail (Show of demand)

In hindsight, selling ANGELONE seems to be a bad decision. I sold the stock without following my sell rules and with the only aim of protecting my gains.

This seems to be due to Fear of missing out (FOMO) of my profits. By doing this I missed an easy 30-40% more profit potential.

But in real time, I felt that the stock was over extended and at the same time, all other stocks in my portfolio started hitting my trailing stop loss and the INDEX went down 50 DMA decisively with poor global indices performance.

This is one of the strongest stocks I held in my portfolio at that time, so I am waiting to enter again at the right time if possible.

If I had to exit the stock it should have been yesterday or today (23/01/2024).

I should have exited, when it broke the 50 DMA strongly and also broke the RS PIVOT.

DISCLAIMER:

Kindly note that this is not a sell recommendation to ANGELONE. If you are holding this stock, do hold it until your stop loss criteria is met. The stock may rebound like anything tomorrow itself and start running higher again. I had just explained my way of exiting this stock and nothing else. In the stock market, we can make money in “N” number of ways and I am discussing just one of them.

Happy Investing !!!