There are plenty of articles available nowadays regarding savings and investments. Topics like “How to save for your future? How much money you need to save every month to achieve financial freedom?” are very common. However, most of these articles revolve around the lifestyle of salaried individuals who get a pre-set income. The amount they can invest or save can be easily pre-determined with good accuracy. They can even predict when there will be a pay hike, how much they will get as an increment after some particular year when they will be getting a promotion etc., This makes them easy to plan their financial goals with good accuracy. But it is not the case for self employed.

How a self-employed life is different from others?

The lifestyle of a self-employed say for a Doctor having his/her clinic, an Engineer sketching plans for individual houses, an interior designer, any freelancer rendering his/her services, is very different from salaried individuals. Words like PF, company allowances, appraisals, bonus, have no relevance to them. They are on their own as they are entrepreneurs in their way.

These people mostly earn money on a daily basis. Regardless of their job be it a Doctor, interior designer, or a person owning a Photostat shop they have many monthly fixed recurring expenses like rent, EMI (Business loan if any), EB Bill, Broadband bill, assistant salary, sweeper salary, etc., Apart from this they may need to procure new things from time to time (like UPS, generator, new machinery, a new software, etc.,) maintenance of existing machinery, updating the office interiors as the business grows, branding and increasing their online existence and the list goes on.

Turnover versus Take Home Income:

The turnover of the business may seem to be great and higher compared to salaried individuals, but their net income will tell another story. For example, depending on the type of job, in most cases, the net income may range from just 20% – 60% of the turnover. Another catch is, the turnover is not a fixed number and it will vary from month to month. However, the fixed expenses like rent, EMI, salary to workers, etc., will remain the same irrespective of the turnover and business they made that month. Whether there was any profit or not they should meet up their fixed monthly expenses. Also, no one can tell when the business will scale up to the next level, there is no promotion, no pay hike, etc., The unpredictability and lack of a regular fixed income makes investments and saving decisions even more difficult for these people. Most of the time their income is not well documented and most of them even don’t know what their exact take-home income is.

Income cycles:

Just like the share market, the monthly income of these individuals falls under three categories.

Bull (High income-generating months),

Bear (Low income-generating months),

Sideways (neither too high nor too low).

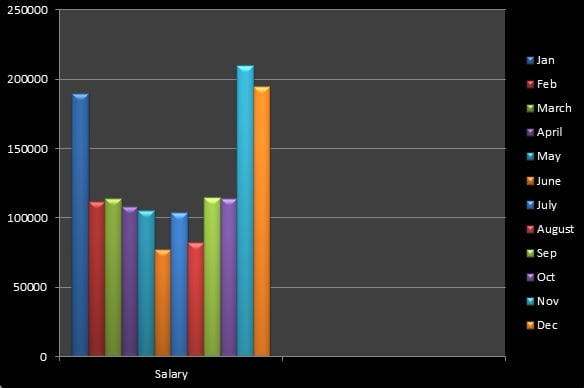

Just like the general market, most of the time the income will be sideways, implying that the net income will be similar to fixed income with very minimal variations (5 – 10 %). However, there will be one or two months which will have extraordinary turnover with a 30-40% rise than the normal turnover, and one or two months with poor turnover (20-30% less the normal turnover). The following graph represents the imaginary monthly net income of a small textile shop:

We can see that the major income comes from January, November, December which might be due to festivals like Diwali, Navaratri, Christmas, New Year, etc., and poor incomes were generated in June and August. All the other months showed a range of 1,04,000 – 1,15,000 INR.

With some little variations in the numbers, most of the self-employed businesses will have one or two roaring turnover months and others within an expected range. For example, in the case of a person running a Photostat & Printing shop, his income will be more during the exam semester months and will be poor during college vacations.

Problem of not averaging the income for self-employed:

The problem comes when we fail to understand the averages of these incomes. In the above example, the average of the entire 12 months is approximately 1,27,000 INR. But, if we remove the high-income months of January, November, December the average income is just 1,03,444 INR. A staggering difference of 23,556 a month!!!

Imagine, what happens when we miss this calculation. The person running the business knows that his/her normal range of income is 1.04 – 1.15 Lakhs per month. So his savings plan revolves around it. During the high-income months, when there is a sudden spike, he tends to do more expenses as the cash flow is high phenomenally and it gives a false sense of confidence that his business is picking up. He spends more and saves less in those months. And the worse is, during June and August when the income is less than his income range, he saves less and his expenses almost remain the same.

What can be done?

So, it’s very important in a self-employed business, that one should have clear data of how much he/she earns every month and what’s the near approximate take-home income is. Keeping a tight note of all expenses and gross income and finding the net take-home income every month is very crucial. From this data, it’s easy to get an average of monthly take-home incomes. The more the data one collects, the more the accuracy will be the financial planning, based on that average. Otherwise, this mistake may cost badly in long run and one might have missed a lot of time and money.

I hope that this article gives an insight into money management if you are self-employed. Averaging your income is a very simple but effective method to avoid over-spending or under-investing. So, next time when your income shows an unusual spike, remember to average that extra income to the other months, which were not that much profitable. You are the boss of your business and you should be very clear about every penny that is coming in and going out.

If you are a beginner in your investment journey you may like to check this out –https://wealthinzen.com/the-first-thing-you-should-do-before-planning-financial-freedom/

One thought on “Best Investment Idea for Self Employed- Income Averaging – Don’t miss to do this!!!”