SIP or Systematic Investment Plan is the most common word you will see whenever you are reading financial related news. Almost all the articles you read will boast of facts like how SIP can change your life, how SIP is a boon for retailers etc., While, most of these things are true to a larger extent, it’s not that much “Rosy” as being portrayed.

SIP is a disciplined way of investing your hard earned money. The advantages of SIP or Systematic Investment Plan are more than it’s disadvantages. However, there are certain points and nuances you should be clear about before starting your investing journey. We will discuss these points in this article and help you understand SIP in it’s true sense.

ADVANTAGES

- Minimal Investing amount

- Easy to start with Auto debit facility

- Rupee cost Averaging

- Disciplined approach to investing

- Organic growth of your savings

- Ability to beat inflation in long run

- Tax efficient

DISADVANTAGES:

- Requires Clear Goals and Target

- Liquidity Risk

- Difficult for people with unpredictable income

- No scope for testing waters

- Needs Patience without getting frustrated

- Frequently interfering and changing the Mutual Fund schemes

- SIP’s in multiple mutual funds

- Misunderstanding the concept of Compounding in SIP

- Key Takeaways

ADVANTAGES:

Minimal Investing Amount:

The most important advantage of SIP is that it makes it easy for anyone even with very average income to invest in the Equity market. Anyone can start a SIP with a very minimal amount of 500 INR. Through the SIP investment every month the portfolio grows slowly and it gives time to the person invested to understand how these things work. It is like the piggy bank we used to have where we will be putting some amount each time we get money from parents, relatives.

Easy to Start:

Almost all the banks have the option of starting a mutual fund SIP with them. Just fill in some documents and give your mandate and every month the amount set by you will be auto debited from your account and will be invested in equities. If you want to stop this auto debit facility for some reason that also can be done very easily. You can change the SIP amount in case of any need easily. All this can be done online through the app specified for that. This ease of investing has attracted many people from all aspects of life.

Rupee cost Averaging:

This is an amazing concept that helps you achieve fantastic returns in the long run. The market always moves like a wave. It goes up and comes down and the cycle continues. This movement is called Volatility of the market. Since in SIP you are investing a fixed amount every month irrespective of the market conditions, if the market goes down you buy more units and if the market goes up you buy less. This prevents you from being trapped when the market is at an all time high, followed by a series of down move. When you invest lumpsum and the market moves down from the next day with your returns going 15-20 % down in a few weeks you will be terrified by the market and chances are high that you stop investing any further.

Disciplined Approach of SIP Investing:

Investing as such is like a marathon. You should take your investment journey very slow and as you gain more and more knowledge of how the market works, you can start investing more. It gives you much returns when you tend to stay in markets for a longer time and understand how it works gradually. When you opt for SIP you will invest regularly even though you don’t know much about the market. Starting a SIP itself will give you a push to learn about it and you will develop a discipline to invest your money first and then spend.

Organic growth of your savings:

By organic growth, I mean an investment which grows slow and steady. Neither too fast nor too slow. When a beginner starts investing, in a bull market he/she is euphoric. Whatever, money invested becomes higher and higher as the market is in an up move. Enthused by it he/she drastically invests a lot of money. Some people even take personal loans to invest in the market thinking that the market will always move up. Investing your hard earned money without knowing anything about the market in an erratic manner is a sure way for disaster. It may shatter your dream of financial freedom, a distant thing of the past.

SIP is a wonderful method to avoid that. You invest in a disciplined manner so that your investment grows organically.

Ability to beat inflation in long run:

The foremost aim of equity investment is to make sure that we get a return higher than the Bank Fixed Deposits and beat the inflation. SIP gives us the opportunity from the start of our career to invest in equity and need not wait till a large corpus is being saved and then invest. In the long run, in a growth market like our Indian Market it is possible to beat inflation and achieve good returns with peace of mind.

Tax Efficient:

Instead of saving your money only in tax saving PPF, you can diversify and invest in Equity linked Savings Scheme (ELSS). Up to 1.5 Lakhs per year can be deducted from your total income under Sec 80C of Income tax act, 1961, by ELSS schemes. However, these have a lock in period of three years from the time of purchasing units. One thing to be noted is if you are investing every month by SIP mode, each investment will be considered separately.

For example, the amount invested in February 2022 can be redeemed by March 2025, (after three years) and investment of March 2022 can be redeemed by April 2025 and so on. But, considering the lock-in period of PPF which is 15 years this can be a good tax saving alternative.

DISADVANTAGES:

Requires Clear Goal and Target in mind:

The goal of SIP is to create a good corpus in the long run so that one can retire early and become financially free. However, the amount you invest in SIP every month and the funds you select plays a very important role in achieving financial freedom. Most people just start SIP as per their friend’s / relative’s advice without any idea or plan. They sometimes invest in historically poor performing funds with larger expense ratios that will affect their portfolio greatly. You can learn more about Expense Ratios here.

Equity investment requires a clear mind of what and how much you want as a corpus at the end and a target of how long you will be investing. A clear mind makes a clear decision. If you are not able to decide on your own, never hesitate to work with a fee based financial advisor. Remember, that investing some amount every month, without any plan, may be dangerous.

Liquidity Risk:

Liquidity is a term used to refer to how easily an asset or security can be bought / sold in the market. It basically tells us how easily the asset can be converted to cash in a very quick time. The SIPs made in mutual funds are highly liquid and can be sold any day. But, due to SEBI regulations you will require at least a week’s time to get the cash in your account. The processing takes time. So, it is better not to invest your emergency corpus in your equity funds. However, there are certain debt funds and overnight liquid funds which can be quickly converted into cash within a day or two.

Also, if you are investing in ELSS (Equity Linked Savings Scheme) there is a lock in period of three years.

Difficult for people with unpredicted income:

SIPs are a boon to salaried people. They can just make an auto debit facility so that every month the specified amount will be invested in the fund selected. However, for people with unpredictable cash flows or for self-employed people whose income varies each month, it may be difficult to invest equal amounts every month. If you are self -employed with unpredictable cash flows you can read the article on Income averaging, where it is discussed how to overcome this.

No scope for testing waters:

In SIP once you start investing it is very difficult to see immediately whether the investment is working for you or not. Also, the performance reports of the fund you see in websites like value research, money control will be different. This is because the date they took into consideration and the date you invested will vary in most cases. So, it is possible that the funds performance in their report may be positive while your investment portfolio may still be negative.

The only way to succeed in SIP investing is to completely believe in the process and keep on investing. Once you are confident with the fund manager and the fund house, you can gradually scale up. Just discuss with your financial advisor to select a good fund for you or if you want to do it yourself Index investing is also a very good option. In SIP you cannot put some money first and test whether it is increasing or not and then invest more money. This will never work in the SIP system and you will end up with nothing.

Needs Patience without getting frustrated :

People usually want to taste success quickly. They want to see the results as soon as they invest. But if you are someone among those who want to see their portfolios in green the very next day after investing, then you are bound to be disappointed. SIP as said earlier is a very long time game. The more you stay in the field the higher your chances of success.

This is because the market moves in an up and down fashion. You should be ready to see no returns or even negative returns for a very long period of time. This patience and not getting frustrated is very difficult for an average investor.

Frequently interfering and changing the Mutual Fund schemes:

Since, it is very easy to start SIP and the fund houses running their advertisements non stop, enticing the retailers to invest in their fund you may get easily distracted. You will be tempted to change from one fund to another and to stop SIP in one fund and start doing SIP’s in other fund. You may shift from a large cap fund to a small cap fund and then to a Hybrid balanced fund without even knowing your actual risk appetite and what they are meant for.

The CAGR or compounded annual growth rate shown by the fund houses can be highly misleading and it may hamper your SIP journey if you keep hopping from one fund to another.

SIP’s in multiple mutual funds:

In a casual discussion with my friend, he was saying how he has diversified his portfolio and how it has reduced his risk in the market. On further discussion he said that he has invested in 18 mutual fund schemes and is investing 500 INR each month in each of these funds. Of these 9 are large cap funds. He is not the only one doing this. You may also be one. Perhaps,you may be having nine or ten instead of 18 funds.

But, a mutual fund itself is a risk mitigating portfolio managed by a fund manager. Already the mutual fund would have diversified in various stocks. Diversification of investments in various mutual funds will be Di-WORSI-Fication, thereby making your returns worse. Instead of investing in multiple mutual funds of same category invest in different category mutual funds like:

- Large cap Fund – that invests in blue chip stocks,

- Dynamic Asset allocation fund – which invests in both equity and debt component depending on market conditions

- Aggressive Hybrid fund – Which invests 65-80% in equity and remaining in debts

Misunderstanding the concept of Compounding in SIP:

If there is one thing that is most misleading and misunderstood in the SIP investing then it is the power of compounding. Every mutual fund ad tells that you will understand the power of compounding if you keep on staying invested for longer years. While it is true that if you invest for a longer time, you are most likely to become profitable and get a return that beats inflation, the problem lies in the word “Compounding”.

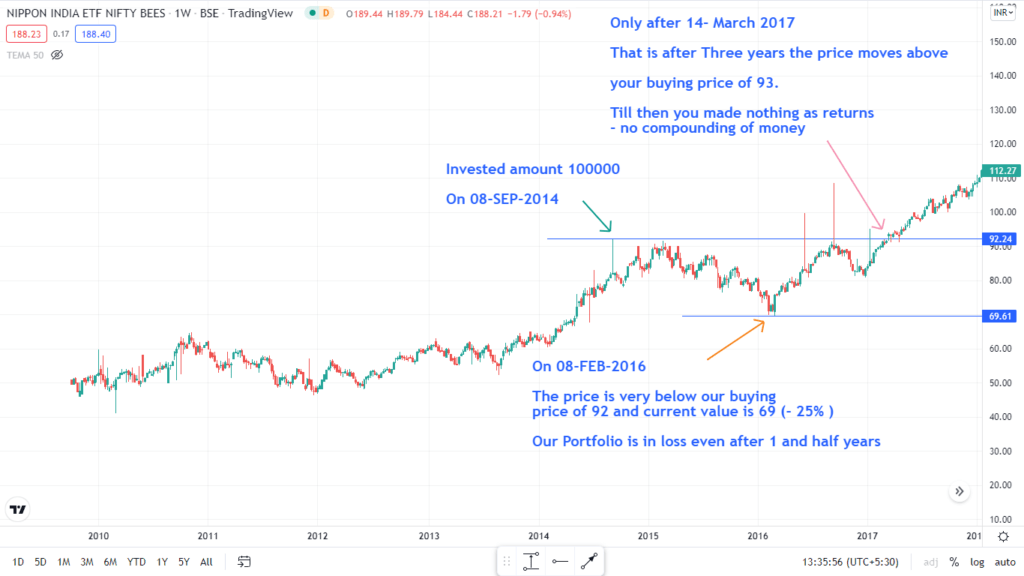

Most of us (including me in my early days) think that there would be some interest that will get compounded each year. But unfortunately, there is no compounding effect as you think in SIP or Lumpsum investment. Let us see with an example, Imagine, you invest 1 Lakh INR in Nippon India Nifty Bees (see the weekly chart below) with a unit value of 92 on 08- September 2014, so total units bought is 1,00,000 / 92 = 1086 Units.

After one and half years the value of per unit decreases to 69 INR as the market moves down, so the current value of investment becomes –

Total Units * Current value per unit

1086 * 69 = 74,934 with a loss of 25% that is 25000 approximately

| Amount Invested | Total Units bought at 92 INR On 08- Sep – 2014 | Value as on Feb-08-2016 after 18 months when the unit price is 69 INR | Total loss @ 25% Approximately |

| 100000 | 100000 / 92 = 1086 | 1086 Units * 69 = 74,934 | 25066 |

Till March 2017 the price of the Unit was less than the buying price of 92. No returns for a period of three years.

If you have invested in SIP mode, the unit price would have been different in different months. In September -2014 it was 92 INR, then in October -2014 it was around 80 and so on. Your purchased units depend on the price of the unit on that particular day of purchase. Where is the compounding here?

Then, if there is no compounding, are the mutual fund companies lying brutally?? No !! There is compounding. But, not in the way you think. Compounding occurs gradually as you keep on investing and buying units every month in a disciplined manner. The units that are being accumulated grows robust and spikes suddenly when the market runs like a bull upwards.

In the above example you can see that after March 2017 the price increases in a rapid manner and gives a huge return. This is the compounding effect they are talking about and you should take it to your advantage.

Key Takeaways:

- SIP is a wonderful method to achieve financial freedom.

- Know your goals before your SIP Journey – Success lies here

- Don’t diversify in same category mutual funds

- Understand what is the meaning of compounding in its true sense

- Don’t Interfere with your investments unnecessarily if you don’t know what you are doing

4 thoughts on “SIP Advantages and Disadvantages – Must know things before you begin your SIP Journey”